If you’ve ever missed a credit card payment or felt trapped under growing dues, you need to understand what the Supreme Court judgement on credit card defaulters really means. In 2024, India’s highest court changed the game — reshaping how banks charge interest, how consumer courts intervene, and how far recovery agents can go.

This isn’t just legal jargon. These rulings directly affect how much you’ll pay, how you’ll be treated if you default, and what rights still protect you as a borrower.

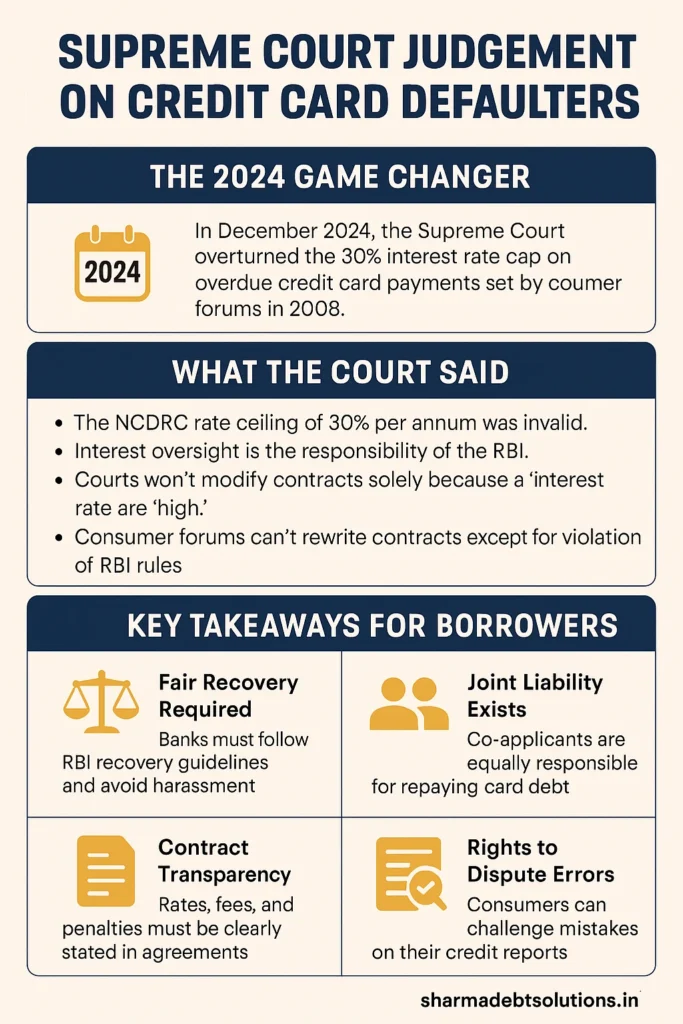

The 2024 Supreme Court Judgement: A Major Turning Point

In December 2024, the Supreme Court of India overturned a 2008 order from the National Consumer Disputes Redressal Commission (NCDRC) that had capped interest on overdue credit card payments at 30% per annum.

What the Court Said

- The 30% interest ceiling imposed earlier was struck down as invalid.

- The Court emphasized that only the Reserve Bank of India (RBI) has authority to regulate credit card interest rates — not consumer courts.

- Credit card contracts are binding agreements. If you signed terms allowing high late payment interest, courts won’t interfere unless there’s illegality or violation of RBI rules.

- Consumer forums cannot rewrite contracts just because interest seems “too high.”

In short, banks now have a free hand to charge more than 30% if it’s clearly mentioned in the contract.

Founder, Sharma Debt Solutions

Loan Settlement Masterclass (Limited Seats)

Learn how banks evaluate settlements, how to stop recovery harassment, and how to settle loans legally & confidently.

Join the MasterclassWhat This Means for You

After the Supreme Court judgement on credit card defaulters (2024):

- Banks can legally charge interest beyond 30%, often reaching 40–45% annually.

- Delaying payments or paying only minimum dues will make your debt grow faster.

- Consumer courts won’t bail you out for “high interest” anymore.

- Your only protection lies in RBI disclosure rules and fair recovery guidelines.

Contracts now rule, not consumer sympathy.

Landmark Case: ICICI Bank vs Shanti Devi Sharma (2008)

This case remains a cornerstone for protecting borrowers from recovery harassment. In this incident, coercive collection tactics led to tragic consequences — prompting the Supreme Court to issue strong warnings against such practices.

Key Takeaways

- Banks are fully liable for their recovery agents’ actions.

- Recovery must follow due legal process, never intimidation or threats.

- RBI guidelines on calling hours, behavior, and professionalism are legally binding.

- Borrowers can file complaints if recovery agents violate conduct codes.

Even after the 2024 Supreme Court judgement on credit card defaulters, this earlier case remains a shield against harassment.

Book a Consultation with the Author

Founder of Sharma Debt Solutions and a well-known authority on loan settlement in India.

Trusted guidance. Clear action. Ethical solutions.

After messaging, you’ll receive payment details.

Confidential • Direct • Result-Oriented

Co-Applicant Liability: The Ranjan Kumar Mitra Case (2015)

In State Bank of India vs. Ranjan Kumar Mitra, the Supreme Court clarified that co-applicants and guarantors are equally responsible for unpaid dues.

If you co-signed for someone’s credit card or loan, you’re legally on the hook — even if you never used the card.

Lesson: Never sign as co-applicant lightly. Liability is shared, not symbolic.

Rights That Still Protect Credit Card Defaulters

Even though banks gained more power over interest rates, the Supreme Court ensured borrowers are not left defenseless.

1. Fair Recovery Practices

RBI rules still apply. No midnight calls, workplace humiliation, or intimidation. You can complain to the RBI Ombudsman if agents cross the line.

2. Transparency in Credit Card Contracts

Banks must clearly disclose:

- Interest rate on late payments

- How it’s compounded (daily or monthly)

- Penalties, GST, and other charges

If any of this is not disclosed properly, you can challenge it under unfair trade practices.

3. Right to Dispute CIBIL Errors

Incorrect default entries on CIBIL or Experian reports can be challenged and corrected. Courts have supported this right in multiple rulings.

4. No Hidden Interest-on-Interest

Banks can charge high interest but cannot compound it secretly unless explicitly stated in the agreement. If they do, it can be struck down in court.

Before vs After the 2024 Supreme Court Judgement

| Aspect | Before (2008–2024) | After Supreme Court 2024 |

|---|---|---|

| Interest cap | Max 30% per annum | No cap – as per contract |

| Consumer court power | Could reduce excessive interest | Cannot interfere unless RBI rules broken |

| Borrower shield | Some relief under NCDRC order | Only disclosure + RBI norms |

| Recovery conduct | Bound by RBI | Still bound (Shanti Devi applies) |

If You’re Struggling with Credit Card Dues

- Stop Ignoring Statements:

Know what you owe and how much interest is being charged. - Negotiate Early:

Banks prefer settlements over legal action. Ask for restructuring or one-time settlement. - Don’t Swipe Again:

Using your defaulted card weakens your negotiation position. - Use Smart Repayment Strategies:

- Snowball method: Clear smallest dues first.

- Avalanche method: Pay off the highest-interest cards first.

- Report Recovery Harassment:

File a complaint with RBI or local police if recovery agents threaten you.

RBI Customer Grievance Portal

How to Protect Yourself Before It Gets Ugly

- Always pay more than the minimum due.

- Read your credit card terms and conditions carefully.

- Maintain an emergency fund (₹15,000–30,000).

- Avoid juggling multiple cards if your income is limited.

- Never co-sign casually — liability follows you.

The Bigger Picture

The Supreme Court judgement on credit card defaulters in 2024 marks a major shift — putting responsibility back on borrowers to read, understand, and manage their financial obligations carefully.

But you are not powerless.

- The Shanti Devi case still protects against harassment.

- RBI rules safeguard transparency.

- Courts still side with consumers in cases of deception or misconduct.

This judgement is not about punishing consumers — it’s about accountability on both sides.

FAQs on Supreme Court Judgement on Credit Card Defaulters

Q1: What happens if you default on a credit card in India?

Banks can now charge over 30% interest, impose penalties, and report defaults to CIBIL. Your credit score drops but can recover with consistent repayments.

Q2: Can banks take legal action against defaulters?

Yes, especially for large amounts. However, most prefer negotiation or settlement before litigation.

Q3: Can recovery agents visit your home?

Yes, but only within permitted hours and without harassment. You can ask for their ID and file a complaint if they behave improperly.

Q4: Will credit card defaults stay in my CIBIL report forever?

Defaults stay for up to seven years, but their impact reduces over time once dues are cleared.

Final Word

The Supreme Court judgement on credit card defaulters (2024) ended the comfort of a 30% interest cap and shifted power toward banks.

But your best defense is awareness and early action.

Read your contracts. Act quickly if dues pile up. Know your rights under RBI guidelines and consumer protection laws.

In today’s India, financial literacy is your legal armor — and this judgement is your wake-up call to wear it.