If you Google section 25 of payment and settlement act, most articles sound like legal textbooks. That’s a problem — because your real concern isn’t the law’s technicalities; it’s your money, your risks, and your protection.

In this article, we’ll break down Section 25 of Payment and Settlement Act in simple language — what it really means for borrowers, how it gets triggered, and what to do if you ever receive a notice related to it.

Let’s simplify it.

Why I’m Writing This (and Why You Should Read It)

I’m not a lawyer. I’m a loan settlement consultant who sees borrowers and business owners caught in legal tangles they barely understand. Many people get notices, threats, or calls mentioning “Section 25” and panic — even though half the time, the issue could have been managed easily with the right awareness.

My goal here is to explain Section 25 from a financial and settlement point of view — what it means, how it’s used, and how to deal with it confidently.

What Is Section 25 of the Payment and Settlement Act?

Section 25 of Payment and Settlement Act is one of the most important parts of the Payment and Settlement Systems Act, 2007. It deals with the dishonour of electronic funds transfer — situations where a digital payment fails due to insufficient funds or limits being exceeded.

(You can read the full Payment and Settlement Systems Act, 2007 (official text) on the Government of India’s law portal)

The Payment and Settlement Act was introduced to regulate India’s growing digital payment ecosystem, including NEFT, RTGS, UPI, and ECS systems, under the supervision of the Reserve Bank of India.

Simply put, Section 25 of Payment and Settlement Act ensures accountability when digital payments bounce, and in many ways, it works like the cheque bounce provisions under the Negotiable Instruments Act.

Conditions When Section 25 Applies

These are the checkpoints that decide when Section 25 of Payment and Settlement Act actually applies and when it doesn’t. Understanding these will help you see whether a notice or complaint made against you is valid.

1. The transfer must be for a debt or liability

You must have initiated the electronic transfer to pay an existing debt — such as an EMI, vendor payment, or settlement amount. If it’s a gift or voluntary transfer, Section 25 doesn’t apply.

2. The instruction must be proper and valid

The transfer should have been made following the correct system process — like proper NEFT or ECS instruction. If your instruction itself was invalid or outside the payment system’s rules, Section 25 is generally not triggered.

3. Written demand notice within 30 days

After the payment fails, the person expecting the money must send you a written demand notice within 30 days from the date they learn about the failed transfer. If they don’t, the case usually loses its standing under this section.

4. Non-payment even after 15 days of notice

Once you receive that notice, you have 15 days to make the payment. If you ignore it or delay beyond that period, the beneficiary can take further legal action.

5. Presumption of liability

Under Section 25, it is presumed that the payment instruction was made for a valid debt. It’s also presumed that the dishonour happened as communicated by the bank. The burden to disprove these presumptions lies on you.

6. No defense of ignorance

You can’t claim “I didn’t know my balance was low” as an excuse. Ignorance of insufficient funds or limits doesn’t protect you under this law.

7. Connection to the Negotiable Instruments Act

Section 25 refers to certain provisions of the Negotiable Instruments Act, 1881 — meaning that cases under Section 25 often follow similar procedures to cheque bounce matters, including how notices and complaints are filed.

Real-Life Situations Where Section 25 Can Apply

Let’s look at how Section 25 of Payment and Settlement Act plays out in real-life financial situations. Most borrowers face it without realizing what triggered it.

A. Failed NEFT for Loan EMI

Suppose you initiate an NEFT transfer for ₹10,000 to pay your EMI, and the transaction fails due to insufficient funds. Once your lender issues a written demand notice and you don’t pay within 15 days, Section 25 of Payment and Settlement Act can be used against you.

B. ECS or Auto-Debit Failure

When an ECS or auto-debit instruction bounces for lack of balance, it may also fall under Section 25 of Payment and Settlement Act, provided all legal conditions are met.

C. Transfer Beyond Agreed Limit

Trying to transfer more than your approved overdraft or limit? That too may trigger a payment failure scenario covered by Section 25 of the Payment and Settlement Systems Act.

In all these examples, the key trigger is non-payment even after proper notice.

What Happens If a Section 25 Case Is Filed Against You

If someone proceeds under Section 25, here’s what usually happens:

- A criminal complaint is filed in the Magistrate court.

- Evidence such as bank communication, failed transaction report, and copy of notice is submitted.

- The law presumes you owed the amount unless you disprove it.

- Punishment can include imprisonment (up to two years), or fine (up to twice the amount), or both.

- However, in practice, most parties prefer settlement or mediation because court cases are time-consuming and expensive.

The goal is compliance, not punishment — courts often encourage resolution if you’re ready to make the payment.

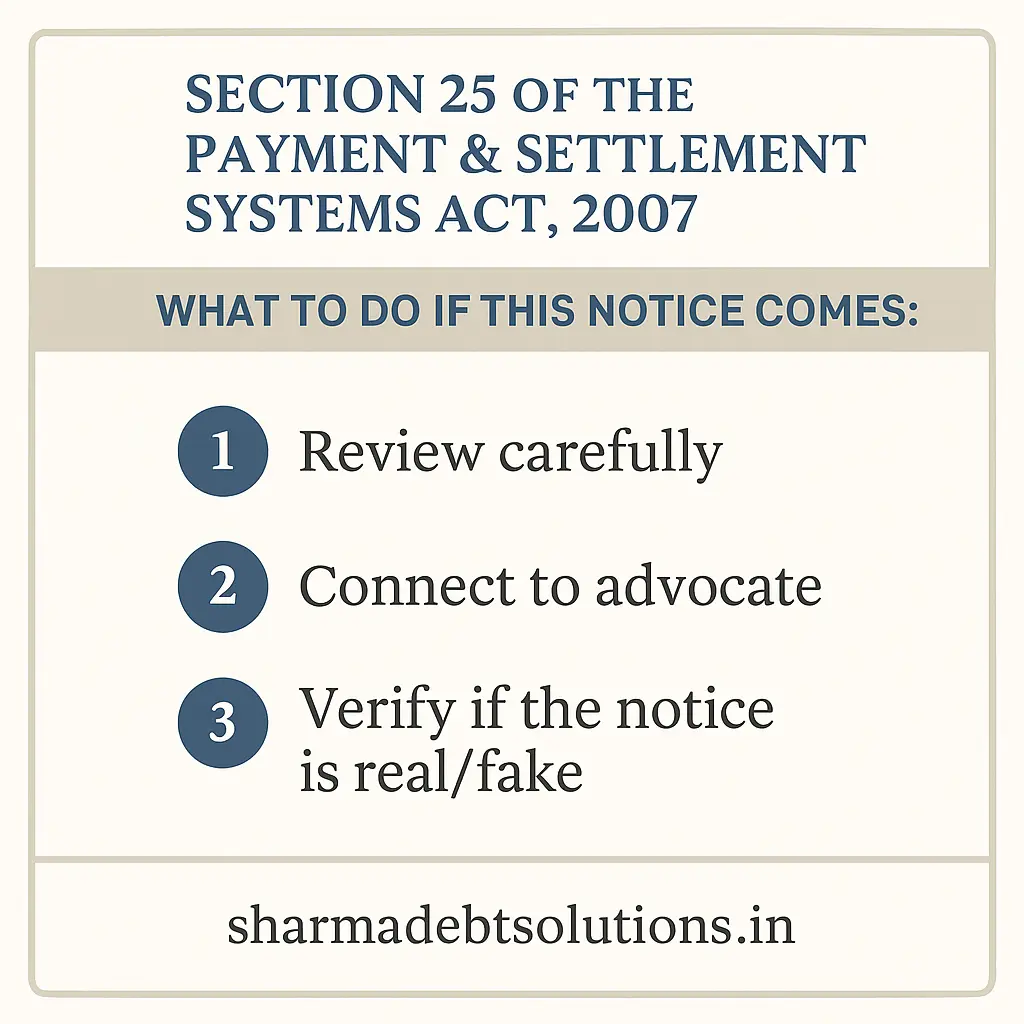

How to Respond If You Receive a Section 25 Notice

Here’s what you should do if you get one of these notices.

- Stay calm and verify

Read the notice carefully. Check whether it mentions the failed transaction details, dates, and whether it was actually for a liability. - Check timelines

Did they send the notice within 30 days of knowing about the failed payment? That’s mandatory. - Respond within 15 days

Pay up or reply officially if you have valid reasons (technical error, duplicate instruction, etc.). Ignoring it can backfire. - Negotiate settlement

Many times, complainants are open to settlement. Use that window — settle fast, in writing, and keep proof of payment. - Keep all communication records

Save bank messages, emails, and transaction references. You’ll need them to defend yourself or clarify later. - Seek help if it escalates

If the matter goes to court, hire a lawyer for representation. We can connect you to independent advocates if needed.

Why Understanding Section 25 Gives You an Edge

Knowledge of Section 25 can actually help you in negotiations or settlements.

- You know the other side’s legal leverage — and yours.

- You can judge whether their claim is valid before agreeing to pay.

- You’ll know when a legal threat is bluff or real.

- It prevents panic decisions or overpayment.

When you understand how and when the law applies, you negotiate from strength, not fear.

Checklist Before You Worry About Section 25

Run through this quick self-check before assuming you’re in trouble:

- Was the failed transfer for a genuine debt or liability?

- Was the payment instruction valid?

- Was a written notice sent within 30 days?

- Have 15 days passed without payment?

- Is there proof of the failed transaction?

- Can you prove the debt didn’t exist or the failure was not your fault?

If even one of these fails, Section 25 may not hold up.

Related & Additional Reading

Conclusion

Section 25 of the Payment & Settlement Systems Act, 2007, is meant to make digital payments accountable — not to scare honest borrowers. It applies only when specific conditions are met, mainly around failed payments for genuine debts and non-payment after notice.

If you’ve received such a notice or expect one, act early. Verify the claim, keep records, and communicate. Often, issues that look “legal” can be resolved through quick, well-documented settlements.

As a loan settlement consultant, I’ve seen both sides — borrowers who panic and lenders who overreach. With knowledge and the right approach, you can manage both.

If you’re facing payment failure issues, settlement pressure, or confusion around Section 25, reach out for a professional consultation. We can also connect you to independent advocates if legal representation is required.

Book a paid on-call consultation via WhatsApp: 9106484927

Get clear, experience-backed advice to protect your finances — without legal confusion.

Disclaimer: This article is for educational and informational purposes only. It explains financial and regulatory concepts in simple language and should not be treated as legal advice. Consultations cover financial and settlement strategy. For legal interpretation or representation, clients are connected to independent advocates who operate separately.