Have you ever been bombarded by nonstop calls or surprise visits from loan recovery agents?

If yes, you’re not alone.

From personal loans to credit cards, many Indian borrowers have faced intimidation, abuse, and even illegal threats — all in the name of “recovering dues.” But here’s the truth most people don’t know: you have rights. And it’s time to use them.

In this guide, we’ll break down everything you need to know about recovery agent harassment in India — including how to stop it, what legal protections you have, and how to document every step to protect yourself.

What is Recovery Agent Harassment?

Recovery agent harassment refers to illegal or unethical behavior by loan recovery agents trying to recover unpaid dues. One of our clients received 87 missed calls from a recovery agent in just 3 days — including on a Sunday. That’s not recovery. That’s intimidation.

While agents are legally allowed to contact borrowers, many cross the line by using threats, abusive language, repeated late-night calls, or showing up at your home or workplace without notice.

These practices violate RBI’s Fair Practices Code and can be challenged legally. As a borrower, you are protected under the law — and knowing your rights is the first step toward fighting back.

Why Recovery Agents Get Away With It

Recovery agent harassment often goes unreported because borrowers feel intimidated or unsure of their rights.Recovery agents are not above the law

Here’s why this kind of harassment happens so often:

- Commission-Based Pressure: Agents only earn when you pay up.

- Lack of Training: Many are unaware of RBI’s code of conduct.

- Deliberate Intimidation: Some banks turn a blind eye to aggressive tactics.

If you feel mentally drained, anxious, or humiliated due to recovery agent behavior, you’re experiencing harassment. And you can fight back.

Is Their Behavior Legal? A Quick Comparison

| Tactic Used by Agent | Legal or Not? |

|---|---|

| Calling after 7 PM | Illegal |

| Visiting without ID or badge | Illegal |

| Threatening to tell family/employer | Illegal |

| Abusive or threatening language | Illegal |

| Publicly disclosing loan details | Illegal |

| Requesting peaceful meeting during daytime with ID | Legal |

Your Legal Rights as a Borrower in India

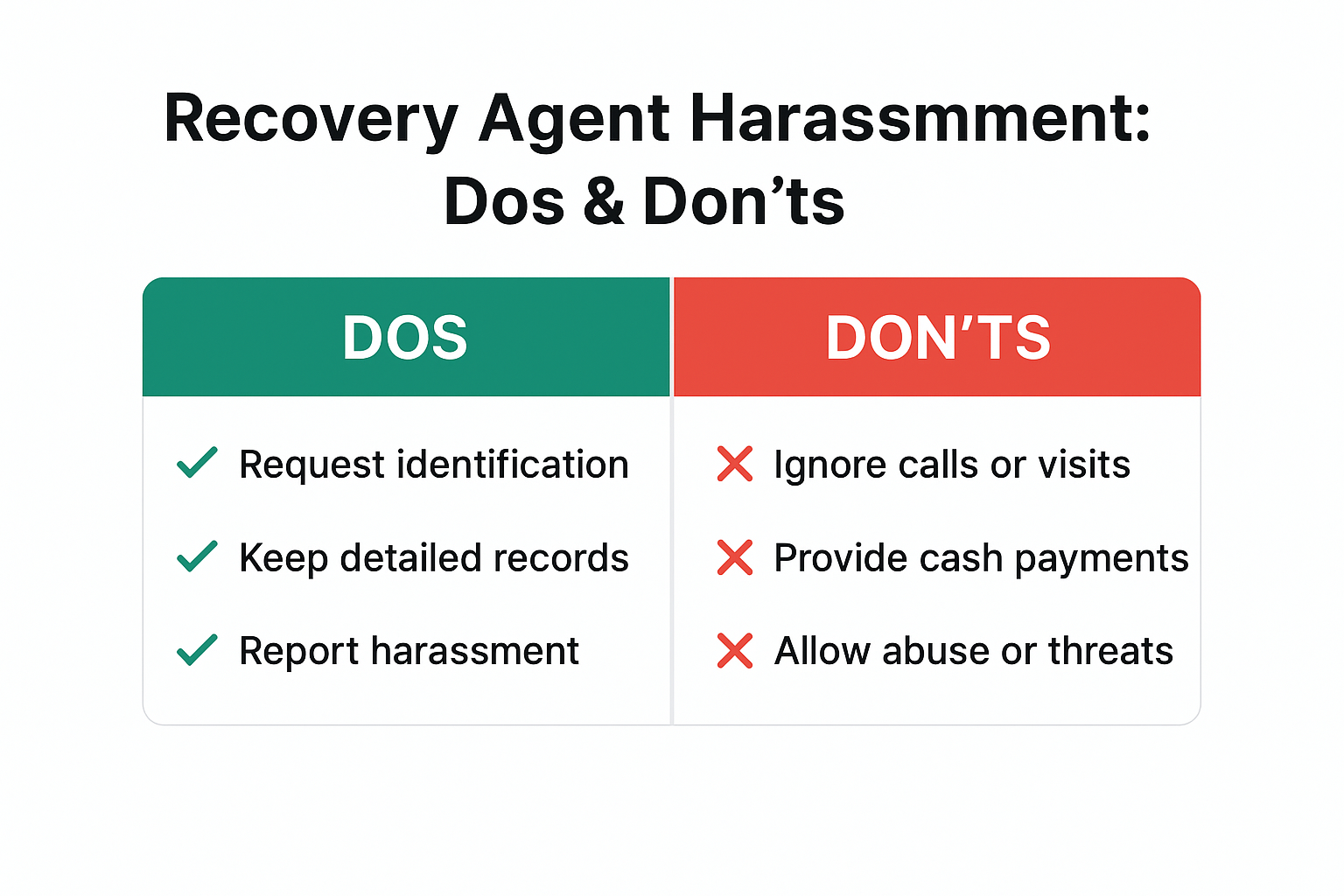

A quick visual guide on what to do (and avoid) if you’re being harassed by a recovery agent.

You are protected by both the Constitution and the Reserve Bank of India. Here’s a snapshot of your rights:

- Right to Privacy: No third party (family, employer) should be contacted without consent.

- Right to Dignity: Agents must behave with decency and respect.

- Right to Restricted Hours: Contact only allowed between 8 AM to 7 PM.

- Right to File Complaint: You can escalate the matter to the bank, RBI Ombudsman, or even file a police complaint under IPC sections like 506 (criminal intimidation).

Remember: Silence is not strategy. Action is.

How to Stop Loan Recovery Agent Harassment (Step-by-Step Actions)

Let’s break it down into a clear action plan.

Step 1: Start Documenting

Save every call, text, WhatsApp message, or in-person visit. Screenshots, call logs, and voice recordings are your best friends here.

Step 2: Send a Written Notice

Draft a polite but firm email or letter to the bank and collection agency. Mention that you are aware of RBI norms and request all communication to be in writing. Also, mention in writing that you’re aware of RBI’s 2025 Fair Practices Code — it makes them nervous.

Step 3: Escalate to the Bank’s Grievance Cell

Every bank has a grievance redressal system. Use it. Lodge a formal complaint and retain the ticket number for future reference. Most banks reply within 3-5 working days. Save your complaint ID or ticket number.

Step 4: Approach RBI Ombudsman

If the bank doesn’t act within 30 days, escalate it to the RBI’s Ombudsman. It’s free, online, and effective.

Step 5: File a Police Complaint

If you’re being threatened, stalked, or defamed, go to your local police station and file an FIR. Mention IPC Section 506.

Step 6: Send a Legal Notice

Hire a lawyer to issue a notice to the bank and agency. This often stops harassment immediately. This sets a legal warning and builds a strong case if you later want to sue for harassment damages.

Download a Free Recovery Harassment Complaint Draft

This sample letter can help you file a complaint with your bank or local police station if you’re being harassed by a loan recovery agent.

Download Complaint LetterNeed a lawyer-signed legal notice?

We’ll send a formal legal notice to your lender on your behalf.

Click here to request now on WhatsApp

Can They Call My Family or Visit My Office?

Here’s a quick myth-buster:

- Calling Your Relatives? Illegal unless you’re unreachable.

- Showing Up at Work? Must be non-public, respectful, and with your consent.

- Using Threats? Absolutely not.

You are not alone. Many borrowers face this, but most stay silent out of fear. Speaking up changes that.

Your Rights Are Backed by the Law

This isn’t a motivational speech. These are actual laws and guidelines from RBI, the Indian Penal Code, and the Supreme Court.

If an agent violates these rules, they — and the lender — are accountable.

Sample Script: How to Respond Calmly

“Please note: I’m aware of my rights as per RBI. You are not allowed to call after 7 PM or visit my home/office without appointment and ID. Further communication must be in writing. Continued harassment will lead to a formal complaint to RBI and legal action under IPC Section 506.”

Say this once. Then follow through with documentation.

FAQs About Recovery Agent Harassment

What happens if a recovery agent harasses you?

If a recovery agent harasses you, you can take legal action. File a formal complaint with the lender, escalate to RBI’s Ombudsman, and if needed, lodge a police complaint under IPC Section 506. Harassment includes abusive language, threats, repeated calls after 7 PM, or showing up uninvited.

What is the new rule for recovery agents?

As per RBI’s 2025 guidelines:

– Recovery agents can only contact between 8 AM and 7 PM

– Must carry proper ID and authorization

– Cannot contact family or friends without a valid reason

– Harassment and public disclosure are banned

What is the IPC section for recovery agents harassment?

Section 506 of the Indian Penal Code (IPC) applies to criminal intimidation by recovery agents. If they threaten or harass you, you can lodge an FIR. Depending on the nature of the abuse, IPC sections 504 or 509 may also be applicable.

Can a recovery agent come to home without permission?

No. Recovery agents must notify you before any visit. They can only come between 8 AM and 7 PM and must carry proper ID. Surprise visits or aggressive behavior at your home is considered harassment and is punishable by law.

Can they arrest me if I miss EMIs?

No. Loan default is a civil matter, not criminal.

What if my number is shared with other agents?

Lodge a data privacy violation complaint with RBI and police.

Need Help Dealing With Recovery Agent Harassment?

At Sharma Debt Solutions (a registered MSME under Govt. of India), we’ve helped hundreds of borrowers stop illegal calls, file complaints, and settle loans the right way.

If you’re facing harassment, you don’t have to go through it alone.

Book a confidential paid consultation:

Click here for WhatsApp support

Please note: We are not a law firm. However, we work with a trusted network of independent advocates who assist with notice support and documentation. All help is discreet and borrower-focused.

Final Thoughts: Take Back Control

You’re not weak. You’re just not informed — yet.

If you’re experiencing recovery agent harassment, remember — you have every right to take actionThis guide is your starting point. Your next step is action. And neither are banks. If they break RBI rules, you can break their rhythm by using the system against them.

Don’t let recovery agent harassment disrupt your peace of mind — now you know how to respond.

Need Help?

Facing harassment and want professional help to end it fast?

Book a confidential phone consultation with Mr. Sharma, founder of Sharma Debt Solutions: 9106484927

Or get expert WhatsApp-based help: Click here to chat

We’ve helped thousands across India. You could be next.

Want more resources to protect yourself from harassment and debt stress?

Download the Free SDS Harassment Log Tool – Trusted by 1000+ borrowers.

Author: Mr. Sharma, Founder of Sharma Debt Solutions – India’s leading debt settlement support platform.

Disclaimer: This article is for informational purposes. For legal advice, contact a licensed advocate.

Authored by Mr. Sharma

Founder of Sharma Debt Solutions and India’s go-to expert for legal loan and credit card settlement. With hundreds of borrowers helped across the country, Mr. Sharma combines hands-on support with practical tools like the SDS Harassment Log and many more.

Message on WhatsApp