Credit card bills piling up faster than you can clear them? Minimum payments barely scratching the surface? You’re not alone. Millions of Indians fall into the same trap every year — swiping for convenience and ending up in a cycle of compounding interest.

The good news: you can get out of it — legally, smartly, and permanently. This guide expands on the practical steps, timelines, psychology, and legal realities so you know exactly how to settle credit card debt in India and rebuild your financial life.

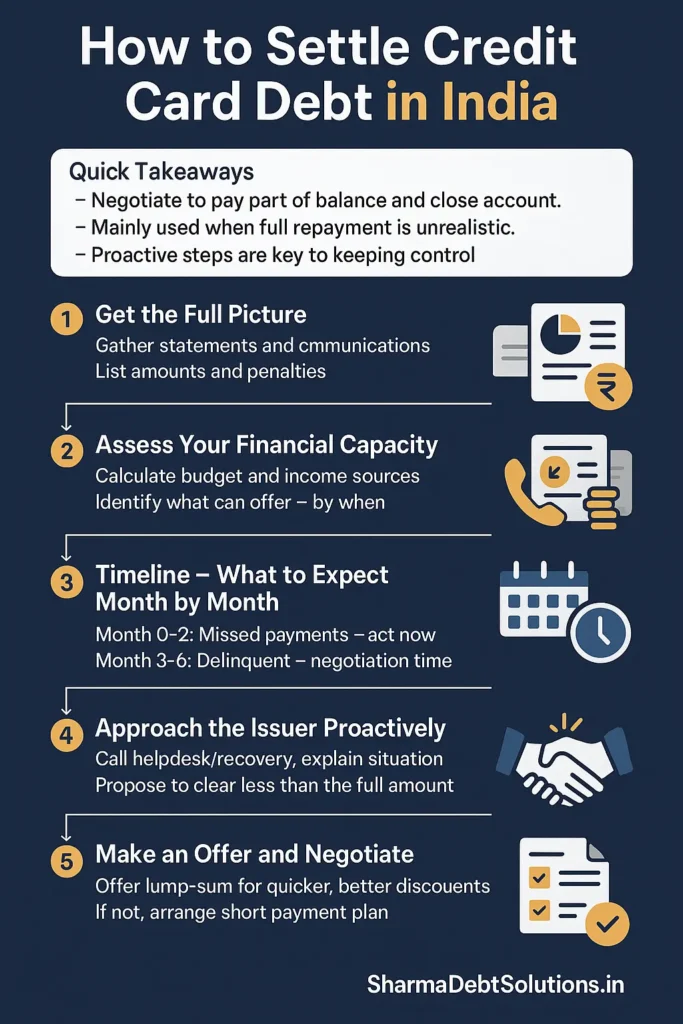

Quick Takeaways

- Credit card settlement means negotiating to pay a portion of your outstanding balance and closing the account.

- Settlement is generally for when full repayment is impossible; it stops interest compounding and collection pressure.

- Acting early, documenting everything, and rebuilding your credit behaviour are essential to recovery.

- There are realistic timelines and steps you can take to protect your rights and reputation.

Understanding Credit Card Debt Settlement

Credit card settlement is a mutual arrangement: the issuer recovers part of the outstanding amount and the borrower stops incurring further interest and penalties. Settlement is a pragmatic choice when regular repayment is no longer feasible. It is not debt forgiveness; it is a negotiated compromise.

When to Consider Settlement

- Multiple missed payments with no realistic path to full repayment.

- A sudden income drop, job loss, or medical emergency that makes normal repayment impossible.

- Accounts moved to recovery or collection agencies and interest/fees have ballooned.

- You prefer a one-time closure rather than indefinite pressure and more interest.

Step-by-Step: How to Settle Credit Card Debt in India

Step 1: Get the Full Picture

Gather every statement, notice, and communication related to your cards. For each account, record:

- Total outstanding amount

- Interest rate and penalties applied so far

- Months overdue

- Whether an agency is handling the account

Having a clear ledger lets you prioritise and prepares you for realistic negotiation.

Step 2: Assess Your Financial Capacity

Build a simple budget: net income minus essentials (rent, food, utilities, transport). Identify:

- Lump sums you can liquidate (savings, sale of assets)

- Extra income potential (freelance work, short-term gigs)

- How much you can offer now without defaulting on essentials

If you can offer a meaningful lump sum in 30–90 days, you have negotiation leverage. If not, prepare a short-term payment plan proposal.

Step 3: Timeline — What to Expect Month by Month

Understanding the timeline reduces fear and helps you plan:

- Month 0–2: Missed payments and warning calls — interest rises. Act now.

- Month 3–6: Accounts are classified as delinquent; banks start provisioning and may refer to recovery. This is often the window where negotiation yields better discounts.

- Month 6–12: Accounts may be transferred to collection agencies; offers still possible but vary. Avoid ignoring the issue.

- Beyond 12 months: Legal recovery or written-off accounts can complicate things; settlements still occur but may look different.

Step 4: Approach the Issuer Proactively

Don’t wait for aggressive collectors. Call the issuer’s recovery/helpdesk; explain your hardship succinctly and state your intent to resolve. Example script:

“I’m unable to continue payments due to [reason]. I want to clear my dues responsibly. Can we discuss a settlement option?”

Politeness plus preparedness gets you a cooperative response.

Step 5: Make an Offer and Negotiate

Start with a realistic but low opening offer—roughly 35–50% of the outstanding balance if the account is significantly overdue. Expect a counter-offer. The goal is to reach an amount both sides accept. Key negotiating points:

- Offer a quick lump-sum if possible; it boosts acceptance.

- If you can’t pay a lump-sum, propose a short payment schedule (2–6 months).

- Ask if any late fees or additional interest can be waived as part of the deal.

Never accept terms without written confirmation. The settlement letter must state final amount, payment schedule, and a clause that the account will be marked “settled” upon receipt.

Step 6: Pay Safely and Get Written Proof

Use traceable payment methods (bank transfer, cheque, official payment gateway). After payment, ask for:

- Immediate receipt of payment

- Settlement confirmation letter or no-dues certificate

Store these documents; they’re your defence if reporting errors happen.

What Happens If You Don’t Settle Credit Card Debt

Ignoring debt makes matters worse. Interest compounds; collection agents escalate contact; civil suits can follow. Practical consequences include:

- Exploding balances due to compounded interest

- Persistent calls and possible home visits by agents

- Civil recovery lawsuits that can lead to court judgments and attachment of assets in extreme cases

- Significant drop in credit score that blocks future borrowing

Acting early not only costs less but preserves more options.

Legal Rights and Protections

Know your rights:

- Credit defaults are civil issues, not criminal. You cannot be jailed for non-payment.

- Collection agents cannot harass, threaten, or make false claims.

- You have a right to written communication regarding recovery and settlement offers.

- If harassed, escalate to the bank’s grievance channel and, if necessary, the banking ombudsman.

Keeping calm, documenting interactions, and using formal complaint routes protects you.

If you’re struggling with multiple loans or want expert guidance to manage your entire debt resolution process, read our complete guide on Loan Settlement Agency in India. It explains how professional consultants handle negotiations legally and help you close debts the right way.

How Banks and Collectors Think: Psychology of Negotiation

Understanding the other side helps. Banks treat delinquent cards as potential losses. After a certain period, they prefer a partial recovery rather than zero recovery. This is why:

- Older delinquent accounts often get larger settlement discounts because the bank has already provisioned for a potential loss.

- Quick lump-sum offers are attractive because they immediately recover cash.

- Showing genuine intent and documentation signals lower collection cost, increasing settlement probability.

Use this logic: present a credible, immediate recovery option and you’ll increase your success rate.

Common Myths About Credit Card Settlement

- Myth: Settlement erases all records — False. It usually remains on your report as “settled” and affects credit history.

- Myth: Banks will blacklist you forever — False. Banks may be cautious, but responsible behaviour rebuilds trust.

- Myth: Settlement always destroys credit — False. It impacts your score, but disciplined recovery restores it.

- Myth: Agents can force illegal action — False. They cannot arrest or illegally seize property; legal processes exist for recovery.

Impact on Credit Score: A Detailed Recovery Roadmap

Short-term impact

Expect a noticeable drop in score immediately after settlement is reported. The severity depends on prior credit health; pristine profiles drop more.

12-month plan to rebuild

- Month 1–3: Ensure all settlement documents are correctly reflected in your credit report. Dispute errors immediately.

- Month 3–6: Get a secured credit card or a small-limit card; use it minimally and clear balances on time.

- Month 6–12: Keep utilization under 30% and avoid multiple loan applications.

- Month 12–24: Lenders begin to see a pattern; score often recovers significantly with consistent good behaviour.

Practical Tips to Rebuild Faster

- Pay every bill on time—even small utility bills count.

- Use a low-limit card and pay the full statement monthly.

- Avoid taking high-interest credit in the meantime.

- Keep emergency savings to prevent falling back into debt.

Real-Life Examples and Scenarios

Scenario A — Single card, heavy balance:

A borrower with ₹3 lakh overdue offers ₹1.3 lakh lump-sum after three months of saving. Bank accepts; account marked settled. Score drops but recovers after a year of disciplined payments.

Scenario B — Multiple cards:

When multiple cards are overdue, prioritise either the highest-interest balance or the smallest one for a quick psychological win. The technique depends on cash availability and negotiation outcomes.

Scenario C — Post-settlement mistake:

If the bank incorrectly reports your account even after settlement, use the settlement confirmation letter to dispute the error with the credit bureau and the issuer. Keep proof of all transactions.

Comparison Table: Settlement vs Other Options

| Option | What It Means | Impact on Credit Score | When to Use It |

|---|---|---|---|

| Full Payment | Pay the full outstanding | Improves score | You can afford to clear dues |

| EMI Restructuring | Convert dues into EMIs | Mild temporary dip | You have stable income but need breathing space |

| Settlement | Pay part of total dues and close account | Moderate dip, recoverable | You cannot afford full amount |

| Ignore Default | Avoid payment entirely | Severe damage + legal risk | Never recommended |

Detailed Negotiation Scripts (Practical Lines to Use)

Use short, unemotional scripts. Here are templates you can adapt:

Initial call / email:

“Hello, my name is [Your Name]. I am calling about account number XXXX. Due to [job loss/medical emergency/reduced income], I am unable to continue paying the current dues. I want to resolve this account responsibly. Could you connect me to the recovery team to discuss settlement options?”

When they give a counter-offer:

“Thank you. I can arrange a lump sum of ₹[amount] within [days]. If you accept this as full and final settlement, will you confirm the terms in writing and mark the account as settled?”

If pushed for more:

“I understand. My current realistic maximum is ₹[amount]. I’m ready to pay that today if you agree to settlement. Please send written confirmation.”

Checklist: Documents and Steps You Must Keep

- Latest statements for each card

- All notices or emails from the issuer or collector

- Bank transfer receipts and payment confirmations

- Settlement letter / No Dues Certificate

- Screenshot or PDF of your credit report after settlement

- A short summary document listing dates and people you spoke with

Tax and Accounting Considerations

If a portion of your debt is written off, some lenders may issue a statement showing the forgiven amount. This could be considered taxable income. It is wise to:

- Keep settlement documentation handy for tax filing

- Consult a tax advisor if the forgiven amount is substantial

- Confirm how to treat one-time settlement in your personal books

Emotional and Practical Support

Debt stress is real. Consider these practical measures:

- Talk to a trusted friend or family member who understands finances

- Avoid social isolation; stress can worsen decision making

- If needed, consult a financial counsellor or a certified debt advisor

- Do small daily wins: tracking progress, celebrating each paid account

How Professional Help Can Be Structured

A trustworthy consultant should:

- Offer a clear fee structure (fixed fee or small percentage) upfront

- Provide a written engagement contract

- Negotiate on your behalf and hand over final settlement documents

- Avoid guarantees that sound too good to be true

Red Flags: When to Walk Away from an Adviser

- Pressurising you to pay upfront without proof of negotiation

- Promising unrealistically high discounts without a clear plan

- Not providing clear written terms for their service

- Asking you to hand over credit cards or bank access

Feel stuck and don’t know how to settle debt?

WhatsApp us for a short consultation — quick, private, and practical.

Timeline Summary: What to Expect After You Settle

- Immediate (0–7 days): You pay and receive an acknowledgment.

- Short-term (1–2 months): Issuer updates their internal records and sends settlement confirmation.

- Medium-term (2–3 months): Credit bureau records reflect the settlement. Check your report.

- Long-term (6–24 months): Your credit behaviour and new borrowing habits determine recovery speed.

Extra Tips for Faster Recovery

- Keep small emergency savings to avoid immediate relapse.

- If you receive a bonus or unexpected income, use 50% to pay down other debt or add to savings.

- Consider non-credit ways to meet expenses (community support, temporary side work) instead of new high-interest credit.

Final Checklist Before You Act

- Do you have a realistic number you can pay today or within 90 days?

- Have you documented every communication with the issuer?

- Do you have a secure method of payment that leaves a clear audit trail?

- Have you considered the short-term credit score hit and planned how to rebuild?

- Do you have settlement terms in writing before paying?

Conclusion

Settling credit card debt in India is a practical, legal, and often necessary step for many people. The process is manageable if you approach it with clarity, documentation, and a realistic plan. Act early, negotiate calmly, and focus on rebuilding your credit behaviour. With discipline and the right steps, you’ll come out of settlement with a manageable financial life and a roadmap to future creditworthiness.