If you’ve ever wondered “What is OTS?”, or you’ve heard someone say “Bank ne OTS diya,” and you want complete clarity — this guide is for you.

This is the single most comprehensive, practical, India-specific explanation of what is OTS, how it works, when you should use it, and how to negotiate it smartly.

Let’s break it down in a simple, engaging, and brutally honest way.

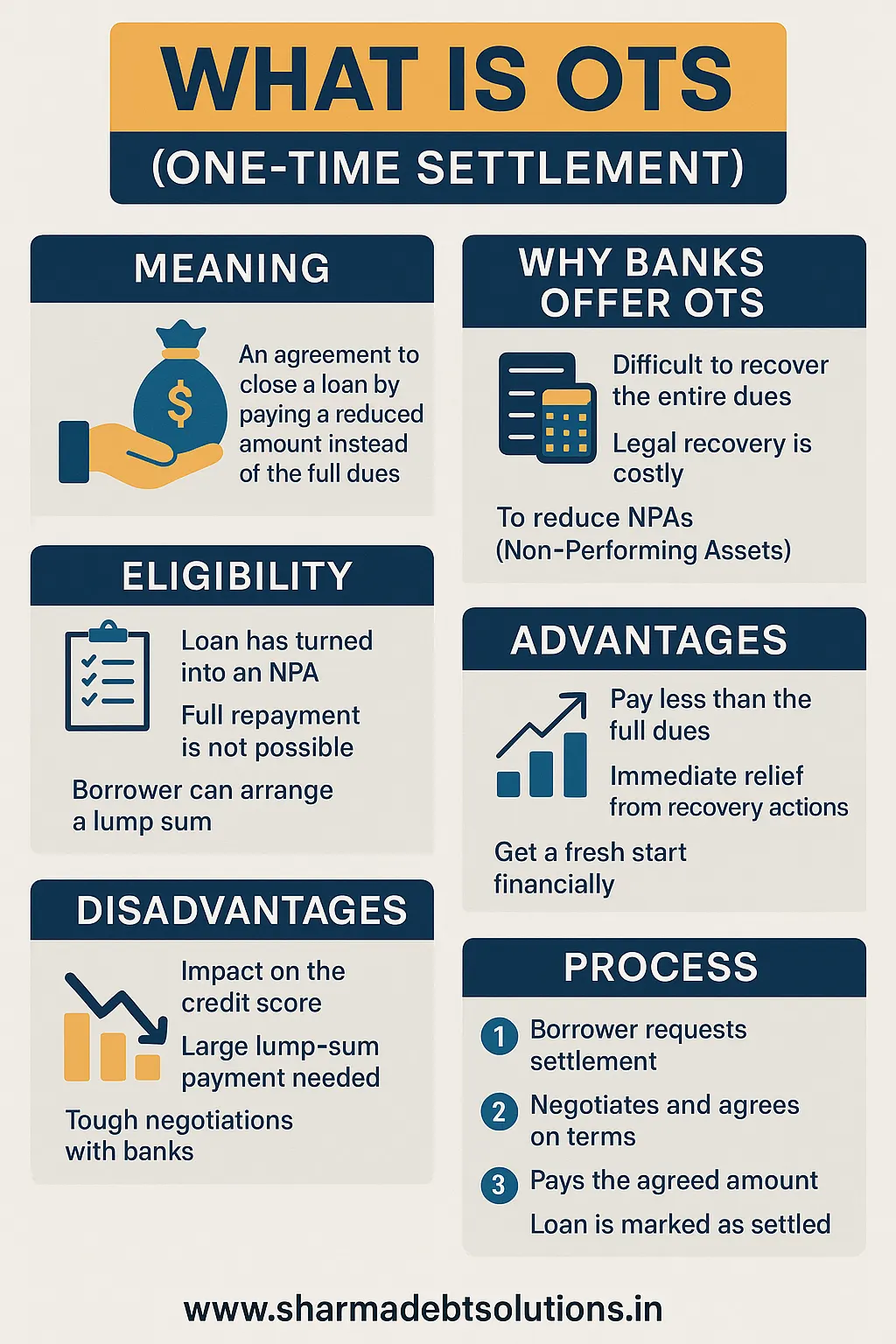

What is OTS (One-Time Settlement)?

Let’s answer it straight.

OTS is “One-Time Settlement”.

It’s a formal agreement between a borrower and a lender to close a loan by paying a reduced amount instead of the full outstanding dues.

When you ask, “What is OTS?”, it simply means:

- The borrower pays a discounted lump sum

- The bank writes off the remaining dues

- The loan is closed as settled, not “fully paid”

- Recovery pressure, notices, and penalties stop immediately

In short, OTS means a negotiated exit from a difficult loan.

Many Indians search online to understand what is OTS in loans, OTS meaning, or what is OTS in banking, because it’s one of the most misunderstood financial processes. You’ll understand it end-to-end here.

Why Do Banks Offer OTS?

If you’re thinking, “Why would banks give a discount?”, it’s a valid question.

Banks offer OTS because:

- The loan has already become an NPA

- Legal recovery is slow, costly and unpredictable

- Getting a partial amount now is better than getting zero later

- Banks must clean NPAs before year-end

- OTS helps them recover something quickly

- Long recovery battles drain time, money, manpower

So when someone asks “What is OTS and why do banks agree to it?”, the short answer is:

Because recovering some money is better than dragging a dead account for years.

Feeling Stuck With Your Loan? Talk to SDS Directly — Today.

If your loan is slipping out of control, don’t wait for things to get worse. Get a personal, one-on-one consultation with SDS and understand exactly what to do next — settlement options, negotiation strategy, documentation, and practical next steps tailored to your case.

Message us on WhatsApp right now and we’ll guide you step-by-step.

Fast. Clear. Confidential.

Limited daily consultation slots. Take the first step before your situation escalates.

Understanding “What is OTS” in the Real Borrower Context

In India, most people search “what is OTS” when:

- Loan EMIs have stopped

- Interest + penalties have blown up

- Recovery agents start calling

- Bank sends notices

- Legal pressure begins

- Collateral is at risk

When the situation becomes unmanageable, borrowers look for something that offers:

- Relief

- Closure

- Mental peace

- A final number they can pay

- A clean finish to the loan

That “something” is OTS — One-Time Settlement.

Types of OTS in India

When discussing what is OTS, it’s important to understand the different forms it can take:

1. Lump-Sum OTS

You pay one single amount → loan closed immediately.

This is the most common type.

2. Structured OTS

Bank allows settlement in short instalments (usually 90–180 days).

Less common, but possible.

3. Collateral-based OTS

If collateral value is low, disputed, or hard to recover, banks prefer OTS.

4. NPA-focused OTS

Loans already marked as “Loss / Doubtful / Bad” often qualify.

Whatever category you fall into, the meaning of OTS remains the same:

Pay discounted amount → get full and final settlement → debt ends.

Eligibility for OTS — Who Can Get It?

If you’re still figuring out what is OTS, you should know who banks usually approve:

- Borrowers with long-term overdue loans

- Loans classified as NPA

- Borrowers unable to repay full amount

- Cases where legal recovery is expensive

- Collateral that has degraded or insufficient

- Accounts where bank believes full recovery is unlikely

- Borrowers who can arrange a realistic lump sum immediately

OTS is a discretionary tool.

Banks don’t have to give it.

You need to qualify.

What is OTS Process? Step-by-Step Breakdown

If you truly want to understand what is OTS, you must understand the process. Here’s the full flow:

1. Borrower requests OTS

You reach out to the bank explaining your situation and proposing a settlement.

2. Bank evaluates

They check your:

- Loan history

- Collateral

- Repayment record

- Chances of recovery

3. Negotiation begins

This is where banks often quote a higher amount than expected. Negotiation is the heart of OTS.

4. OTS offer letter

Once finalised, the bank issues an official letter showing:

- Settlement amount

- Payment deadline

- Terms and conditions

- Confirmation of “full and final” settlement

5. Payment

You pay lump sum or short schedule.

6. Loan closure

Bank updates your account as “settled”, and issues:

- NOC

- Closure letter

- Collateral release

This is the true functional meaning when someone asks:

“What is OTS and how does it work?”

Benefits of OTS

Understanding what is OTS also means understanding its advantages. Here are the biggest:

1. Pay much less than what you owe

A borrower with ₹10 lakh dues may settle for ₹3–5 lakh depending on age of NPA.

2. End of recovery calls

Recovery agents stop calling once OTS is finalised.

3. No legal escalation

OTS prevents legal action like notices or seizure.

4. Mental peace

This alone makes OTS worth it for many borrowers.

5. Get a fresh financial start

Your loan is gone — now you can rebuild.

Drawbacks of OTS

If you’re searching what is OTS and should I take it, you must know the downsides:

1. Credit score impact

Account shows as “settled”, not “paid in full”.

2. Heavy lump-sum required

You need to arrange money quickly.

3. Negotiation challenges

Banks may demand a higher settlement amount.

4. Future loans may take time

Lenders will ask about your settlement history.

5. Collateral issues

If paperwork isn’t perfect, collateral release may delay.

There is no sugar-coating this — OTS helps you close the loan, but it comes with credit consequences.

When Should You Consider OTS?

If you’re asking “Should I go for OTS?”, here’s the checklist.

Go for OTS when:

- Loan has become impossible to pay

- You see no financial recovery soon

- Interest and penalties are exploding

- Recovery agents or legal notices have started

- Collateral is at risk

- You can arrange a decent lump-sum

- You want peace and closure

In all these cases, OTS becomes a life-saver.

When You SHOULD NOT Choose OTS

Avoid OTS if:

- Your income will recover soon

- You can restructure the loan

- You can afford regular EMIs

- You care deeply about credit score

- You can pay full dues slowly

Before choosing OTS, evaluate long-term financial impact.

How to Negotiate the Best OTS Amount

If you’re serious about OTS, this part is gold.

1. Never show too much cash capacity

Banks increase the settlement amount when they sense you have money.

2. Start lower than your actual budget

If your budget is ₹4 lakh, start at ₹2.5–3 lakh.

3. Present a real hardship story

Loan settlement teams respond better to genuine cases.

4. Use financial proofs wisely

Show proof of difficulty — never proof of plenty.

5. Push for lump sum discount

Banks reduce the OTS if you say you can pay in one shot.

6. Insist on proper OTS letter

No written approval = no settlement.

7. After payment, chase documentation

You must collect:

- NOC

- Settlement letter

- No-dues certificate

- Collateral release letter

Knowing what is OTS is one thing — knowing how to hack OTS negotiation is another.

Impact of OTS on CIBIL Score

A crucial part of understanding what is OTS is understanding its impact on your credit report.

- CIBIL marks the account as “settled”

- Score drops temporarily

- Future loan approvals may need explanation

- You can rebuild score through small credit and disciplined repayment

OTS does NOT block you permanently from future loans.

It simply means you need to show financial discipline again.

OTS vs Loan Restructuring — Which Is Better?

Many borrowers confuse restructuring with OTS.

Here’s the clear difference:

Restructuring

- EMIs adjusted

- Tenure extended

- Loan continues

- Credit record is better

OTS

- Loan ends

- You pay less

- Account marked as “settled”

- Better for distressed cases

If you can repay full over time, restructuring is better.

If repaying is impossible, OTS is better.

OTS Myths People Often Believe

While understanding what is OTS, avoid falling for these myths:

Myth 1: Banks give OTS to everyone

Wrong. It’s selective.

Myth 2: OTS clears credit like magic

No. It settles the loan, not the history.

Myth 3: Agents can “guarantee” OTS

Nobody can. Only the bank decides.

Myth 4: OTS is illegal

OTS is fully legal and widely used.

Mistakes Borrowers Make During OTS

If you’re learning what is OTS, learn these common errors too:

- Agreeing verbally without written approval

- Paying token amounts without paperwork

- Revealing too much financial capacity

- Missing the settlement deadline

- Not collecting closure documents

- Trusting middlemen

Avoid these and you’ll avoid 90% of OTS headaches.

Checklist Before You Finalise OTS

- Confirm settlement amount

- Confirm final date

- Confirm “full and final” wording

- Confirm no further liability

- Confirm collateral release

- Confirm credit bureau reporting

- Confirm official letter format

- Keep copies of all documents

This ensures your OTS is bulletproof.

If you’re exploring debt resolution options beyond OTS, you may find our detailed guide on the personal loan settlement process in India extremely useful.

For a full overview of how settlements work in the Indian lending system, don’t miss our article on loan settlement in India .

If you’re trying to understand how much you might have to pay during settlement, check our loan settlement calculator , which helps you estimate realistic figures.

You can also explore common settlement ranges by reading our guide on loan settlement percentage in India .

For borrowers who want an official perspective on loan default and settlement framework, you can refer to the Reserve Bank of India’s official website for regulatory insights.

Conclusion

Now you have a complete, deeply practical understanding of what is OTS — not just the definition, but the strategy, impact, challenges, risks, and smart ways to approach it.

To summarise:

- OTS means One-Time Settlement

- It lets you close a loan by paying a reduced amount

- It removes stress, pressure and recovery actions

- It affects your credit score

- It gives a clean financial reset

- It must be negotiated smartly

- It is best for loans you simply cannot repay

If you carefully follow the steps, prepare your negotiation, and maintain a disciplined financial plan afterward, OTS becomes a powerful tool to reset your financial life.