If you landed here searching for waived off meaning, chances are your bank, lender, or credit card company has sent you an SMS or email saying something has been “waived off.” And now you’re confused — what exactly got cancelled, what remains, and what this means for your loan or credit journey.

Relax — this is the clearest, most practical guide you’ll ever read.

We’re diving deep into waived off meaning, how it affects your loan, credit score, penalty charges, settlement, and even your future borrowings. You’ll get India-specific explanations, real-life scenarios, and a borrower-friendly breakdown.

Let’s begin.

Table of Contents

ToggleWhat Is Waived Off Meaning in Simple Words?

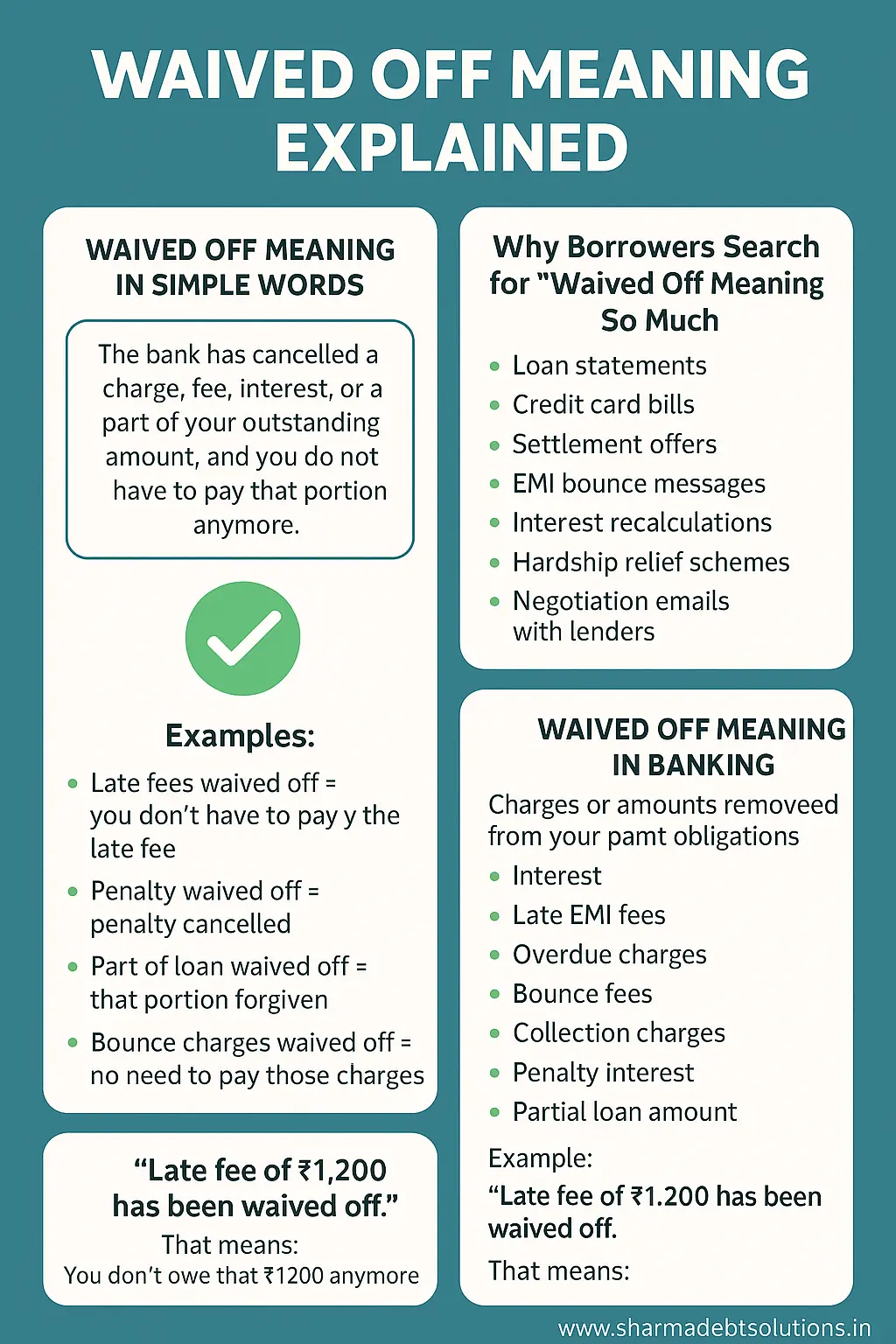

In the simplest English, waived off meaning is:

The bank has cancelled a charge, fee, interest, or a part of your outstanding amount, and you do not have to pay that portion anymore.

If something is waived off, it is removed from your liability.

Examples:

- Late fees waived off = you don’t have to pay the late fee

- Penalty waived off = penalty cancelled

- Part of loan waived off = that portion forgiven

- Bounce charges waived off = no need to pay those charges

Whenever you see the term waived off, the bank is essentially saying:

“We are letting go of this amount — you are free from paying it.”

This is the complete waived off meaning you need to understand.

Why Borrowers Search for “Waived Off Meaning” So Much

In India, the term appears everywhere:

- Loan statements

- Credit card bills

- Settlement offers

- EMI bounce messages

- Interest recalculations

- Hardship relief schemes

- Negotiation emails with lenders

But lenders rarely explain clearly, so people panic.

That’s why the keyword waived off meaning is searched thousands of times.

Borrowers want to know:

- What exactly was waived?

- Does it impact my credit score?

- Is my remaining amount reduced?

- Will the waiver appear on my CIBIL report?

- Does a waiver mean loan closure?

- Is this good or bad for my profile?

This guide answers everything.

Waived Off Meaning in Banking

When you see waived off in a banking context, it refers to charges or amounts removed from your payment obligations.

These may include:

- Interest

- Late EMI fees

- Overdue charges

- Bounce fees

- Collection charges

- Penalty interest

- Partial loan amount

This is the most common situation where people first discover waived off meaning.

For example:

“Late fee of ₹1,200 has been waived off.”

That means:

You don’t owe that ₹1,200 anymore.

Waived Off Meaning in Loans (India-Specific)

In loan accounts — especially personal loans, home loans, credit cards, or business loans — waiver can happen in several ways:

1. Penalty & interest waiver

Banks often waive:

- Penalties

- Additional interest

- Compounded charges

This is the most common Indian use of waived off meaning.

2. Partial loan waiver

Sometimes a part of the principal is waived off in special hardship cases or settlements.

3. Complete waiver

Rare, but possible under:

- Government schemes

- Natural disaster relief

- Severe distress

4. Settlement-based waiver

When a borrower is deeply defaulted, lenders waive off a portion to close the account.

This is where understanding waived off meaning becomes extremely important — because it shapes your financial future.

Waived Off Meaning vs Write-Off — Don’t Confuse Them

Many borrowers think both are the same.

Not even close.

Here’s the difference:

Waived Off

- Borrower is forgiven for that amount

- You don’t have to pay it

- Legally cancelled

- Reduces your total burden

- You can ask for confirmation

Write-Off

- Borrower still owes the money

- Lender just removes it from their accounting books

- Doesn’t mean cancellation

- Recovery can continue

The phrase waived off meaning is always positive for the borrower.

A write-off is simply a bookkeeping move — nothing to celebrate.

Why Do Banks Waive Charges or Amounts?

Once you understand waived off meaning, it helps to know why waivers happen:

1. Borrower hardship

If you genuinely suffered financial crisis, lenders sometimes waive fees.

2. Settlement situations

When recovering the full amount is unlikely, lenders waive a portion to close the account.

3. Relationship value

Long-term customers can get fees waived.

4. System errors

Sometimes incorrect charges are reversed.

5. Government directions

In specific cases, banks follow guidelines that include waivers.

6. To improve repayment chances

Borrowers are more likely to clear dues when penalties are removed.

So there’s a solid strategy behind waivers — and it’s tied directly to waived off meaning.

How Do You Know If Something Is Truly Waived Off?

This part is critical.

Here’s a simple checklist to verify a true waiver:

✔ Written confirmation

Get an email or letter clearly stating the amount waived.

✔ Statement update

Your account or statement must reflect the waived portion as “waived off”.

✔ Revised outstanding

Your outstanding amount must reduce accordingly.

✔ Settlement letter (if applicable)

If it’s settlement-based waiver, get the fresh balance in writing.

Understanding waived off meaning without verifying the backend details can lead to confusion later.

What Borrowers Misunderstand About Waivers

Many people make these mistakes:

❌ Thinking everything is waived

But often only fees are waived, not principal.

❌ Expecting credit score improvement

Waiver does not erase past defaults.

❌ Skipping written proof

Verbal assurance is not a waiver.

❌ Mixing up waiver with loan closure

Waiver only reduces your burden — the remaining amount still needs closure.

Once again, the real waived off meaning is:

A specific amount is cancelled, not the entire loan unless stated.

How Waived Off Reflects in Your Credit Score

This depends on what exactly was waived:

If charges were waived

No major impact — it’s neutral.

If interest was waived

Still neutral — doesn’t erase past delays.

If principal was waived (settlement)

This may reflect negatively:

- Loan may show as “settled” instead of “closed”

- Future lenders interpret settlement as inability to repay

- Approvals for fresh credit may become harder

Knowing the real waived off meaning helps you avoid unrealistic expectations about CIBIL.

Examples Showing Waived Off Meaning Clearly

Let’s break it down with crystal-clear examples.

Example 1: Penalty waived

You missed EMI. Penalty ₹1,500.

Bank waived it off.

Remaining liability: Zero for that penalty.

Example 2: Interest waived

Your loan accrued interest of ₹20,000 during delay.

Bank waived the entire interest.

You owe only principal now.

Example 3: Settlement waiver

Your outstanding is ₹3 lakh.

Bank waives ₹1 lakh if you pay ₹2 lakh.

You pay ₹2 lakh → account closes → ₹1 lakh is waived off.

These scenarios show how helpful it is to understand waived off meaning the right way.

When Waiver Works Best for Borrowers

Here’s when waiver becomes a powerful tool:

- When charges are huge and reduce your chances of repayment

- When settlement can close a long-overdue loan

- When extreme hardship prevents repayment

- When bounced charges keep piling

- When your lender is willing to negotiate

This is where practical understanding of waived off meaning helps you make better decisions.

Waived Off Meaning in Settlement Conversations

Most borrowers hear “waive off” during settlement negotiations.

It may sound like:

- “We will waive off all penalties.”

- “We can waive off interest if you pay principal.”

- “We can waive off 40% as settlement relief.”

In settlement:

- Waiver = lender giving up a portion

- Remaining = amount you must clear

- Letter = proof of what was waived

If you negotiate well, waiver becomes your strategic advantage.

Does Waived Off Mean You’re Safe From Legal Action?

Only if:

- The waiver is documented

- The remaining amount is cleared

- The account is legally closed

Waiver alone doesn’t stop legal action — but it reduces the risk drastically.

Again:

Waived off meaning = cancelled amount.

Not waived off meaning = entire case is closed automatically.

Top Questions People Ask About Waived Off Meaning

1. Does “waived off” mean I don’t owe anything?

Only the waived portion. You owe whatever is not waived.

2. Will my CIBIL improve because of waiver?

Not directly. Only timely repayment improves it.

3. Can I request a waiver?

Yes — depending on situation, lenders may consider it.

4. Is settlement the same as waiver?

Settlement includes waiver but is a broader process.

5. Is waiver better than write-off?

For borrowers, yes — waiver reduces your actual liability.

You can read about Compromise Settlements and Technical Write-offs.

Checklist for Borrowers Who Receive a Waiver

If you see a waiver message, follow this:

- Check the exact waived amount

- Confirm whether it’s principal, interest, or penalty

- Update your repayment plan

- Take a written waiver confirmation

- Verify account statement updates

- Ask for revised outstanding amount

- Plan closure or settlement

- Track your CIBIL after 45 days

Using waived off meaning smartly can help you reduce liabilities and stabilise your finances.

Why Understanding Waived Off Meaning Helps You Make Better Decisions

When you clearly understand waived off meaning, you can:

- Negotiate logically

- Avoid overpaying

- Know your rights

- Avoid fear or confusion

- Understand lender motives

- Make a powerful repayment plan

- Protect your creditworthiness

- Close loans properly

Knowledge = leverage.

Especially in the Indian loan ecosystem.

To understand how a waiver or settlement can affect your future borrowing, read more .

Conclusion

Now you fully understand waived off meaning — not just the dictionary definition, but the practical, real-world relevance in India’s banking and loan environment.

Waived off meaning simply refers to an amount the lender has cancelled and you no longer need to pay. But the real power lies in what you do next:

- Verify

- Document

- Negotiate smartly

- Close accounts properly

- Rebuild credit with discipline

In a country where loan charges, penalties, and interest can multiply rapidly, understanding waived off meaning is not just useful — it’s essential.

If anything in your statement says “waived off,” take it positively, confirm details, and use it as an opportunity to regain control over your financial journey.