“Suit Filed.”

Two words that make the calmest person break into a cold sweat — whether it’s from a lender, a court notice, or your CIBIL report.

But here’s the truth: most people misunderstand what ‘Suit Filed’ actually means.

It’s not automatically a criminal case, nor does it always mean a cop’s about to knock at your door.

In this definitive guide, we’ll decode the full meaning of Suit Filed — legally, financially, and practically — so you know what it really is, how it affects your credit, and what smart steps to take.

What Does “Suit Filed” Mean in India?

In India, “Suit Filed” simply means that a party (usually a lender or company) has initiated legal proceedings against someone for a specific issue — most commonly non-payment, loan default, or breach of contract.

However, not all “suit filed” notices are real court cases.

In finance, it can also mean a credit-bureau entry made by your bank or NBFC to pressure repayment.

Let’s understand both types.

1. Legal “Suit Filed” (Actual Case)

This refers to a civil case officially filed in a court of law.

It happens when:

- A lender files a recovery suit to recover money owed.

- A cheque bounces and the creditor files under Section 138 of the Negotiable Instruments Act.

- A company files a breach-of-contract suit.

- A property or loan dispute reaches arbitration or civil court.

If you receive an actual court summons, that means a legitimate case exists and you must respond legally.

2. Credit Report “Suit Filed” (CIBIL Entry)

This version is the one you’ll find in your CIBIL report — and 90% of borrowers confuse it with a court case.

It means:

“Your lender has reported to the credit bureau that legal action has been initiated due to loan default.”

In many cases, no real court case is ever filed — it’s merely an entry to indicate non-payment and push you to clear dues.

Legal vs Credit Bureau Meaning

| Basis | Legal “Suit Filed” | Credit Bureau “Suit Filed” |

|---|---|---|

| Authority | Civil/Criminal Court | Credit Bureau (CIBIL) |

| Nature | Actual case filed | Reporting entry |

| Impact | Legal obligation | Credit score damage |

| Duration | Until case resolved | 7+ years unless updated |

| How to remove | Court settlement/withdrawal | Dispute with CIBIL or lender |

Is “Suit Filed” Always a Court Case?

No.

That’s the biggest myth we break every single day at Sharma Debt Solutions.

In most credit-related cases, “Suit Filed” is not a real lawsuit — it’s a status tag.

Lenders use it as a recovery pressure tactic, not necessarily as an official filing.

A real lawsuit must come with:

- A case number

- A court name

- A summons or notice

If none of these exist, it’s probably just a reporting entry.

Common Reasons Why “Suit Filed” Appears

- Loan default for 90 days or more

- Credit card non-payment after repeated reminders

- Cheque bounce under Section 138

- Dispute with lender left unresolved

- Non-response to legal or arbitration notices

- Technical misreporting by lender

Even if the loan is old or settled, lenders sometimes forget to update the report — and the “Suit Filed” remark keeps haunting your CIBIL for years.

How “Suit Filed” Affects You

Let’s be brutally honest — this small remark can mess up your financial profile badly.

CIBIL Score Drop

The moment a lender reports “Suit Filed,” your credit score can crash below 600.

Loan Rejections

Banks and NBFCs auto-reject applications with any “Suit Filed” or “Written-off” remark.

Credit Card Suspensions

Existing cards can be frozen or downgraded.

Employment Background Checks

Some companies run credit checks — “Suit Filed” appears as a red flag.

Long-term Visibility

Even after repayment, the remark can stay for up to 7 years unless updated manually.

Types of Suit Filed Cases in India

| Type | Filed By | Typical Cause | Criminal/Civil | Example |

|---|---|---|---|---|

| Civil Recovery | Banks/NBFCs | Loan default | Civil | Personal loan not paid |

| Cheque Bounce | Individual/Lender | Dishonoured cheque | Criminal | Section 138 NI Act |

| Arbitration | Finance Company | Contract clause | Civil | NBFC invoking arbitration |

| CIBIL Reporting | Bank/NBFC | Non-payment | Civil/reporting | “Suit Filed” remark on report |

Legal Meaning of “Suit Filed” in Simple Words

It means someone has formally approached a court or tribunal to claim recovery, damages, or enforcement of a right.

There are two main stages:

- Pre-litigation: legal notice sent.

- Post-filing: actual suit registered with case number.

If you haven’t received any official paperwork, you’re still in the pre-litigation phase — and that’s your window to act smartly.

How to Check If a Real Case Has Been Filed Against You

Before you panic, confirm whether there’s a real case.

Step 1: Visit your state’s court website or ecourts.gov.in

Step 2: Enter your name or lender name in the “Party Name” field.

Step 3: Search district-wise.

Step 4: Check if your name appears under any pending case.

No entry = no official case yet.

Suit Filed in Loan Cases: What Borrowers Should Know

Banks can file a civil recovery suit if a borrower ignores payment for long periods.

However, this process is slow and costly, so most lenders prefer:

- Arbitration

- Collection agencies

- Settlement negotiation

Only in serious defaults (e.g., high-value business loans) do they go to court.

For retail borrowers, “Suit Filed” is often just a data entry on CIBIL, not a summons.

Suit Filed in CIBIL: What It Means for You

When your lender marks “Suit Filed” on your CIBIL profile, they’re basically saying:

“We’ve started or intend to start legal proceedings.”

CIBIL then displays this remark under “Account Information” → “Status.”

Impact:

- Lowers your score instantly.

- Creates perception of high risk.

- Blocks new credit approvals.

How to Fix or Remove It

If the case is not real:

- Contact your lender’s grievance cell.

- Ask for written proof of the “suit.”

- If they can’t provide one — raise a dispute on CIBIL.com.

- Provide your settlement or closure letter if available.

- Follow up till it’s updated to “Settled” or “Closed.”

For detailed steps, read your existing guide on Removing Suit Filed from CIBIL and link internally.

Difference Between “Suit Filed,” “Written-off,” and “Settled”

| Status | Meaning | Effect on Credit |

|---|---|---|

| Suit Filed | Legal/Arbitration initiated | Severe negative |

| Written-off | Amount declared uncollectable | Very negative |

| Settled | Paid less than full amount | Moderate negative |

| Closed | Fully paid and updated | Positive |

| Disputed | Under verification | Neutral until resolved |

What to Do When You Receive a “Suit Filed” Notice

- Don’t ignore it. Silence makes you look guilty.

- Check authenticity. Verify case number, court name, and sender credentials.

- Gather all documents. Loan agreements, payment records, call logs.

- Consult a debt-settlement consultant or lawyer. Don’t reply blindly.

- Negotiate if possible. Many lenders withdraw cases after settlements.

- Document every communication. It protects you later.

- Use tools like SDS Harassment Tracker to log recovery calls and threats.

How to Prevent a “Suit Filed” Status

- Pay minimum dues on time, even during hardship.

- Never ignore legal or arbitration notices.

- Respond in writing, not over phone.

- Avoid cheque-bounces — use auto-debit or UPI.

- Track your CIBIL report quarterly.

- Save all proof of payments or settlements.

Pro Tip: Prevention saves far more than repair — once a “Suit Filed” remark hits your record, even paid accounts take months to recover.

Suit Filed in Credit Card Defaults

Credit-card lenders often file arbitration cases or simply update CIBIL with “Suit Filed.”

They rarely go to court for small balances — it’s not worth their time.

But the remark still damages your score.

So, if you’ve defaulted:

- Ask for a settlement letter.

- Pay only after written confirmation.

- Request “Settled/Closed” update within 30 days.

Case Example (Simplified)

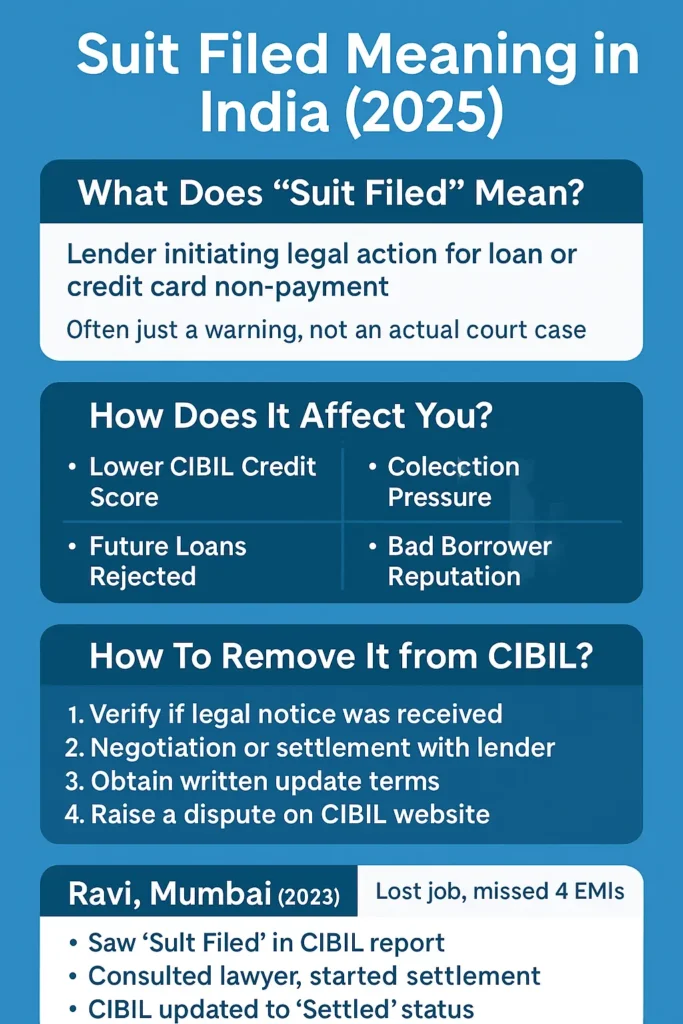

Ravi, Mumbai (2023)

- Missed 4 EMIs on a xyz loan.

- Started getting daily calls; one day saw “Suit Filed”.

- Panicked, thinking police would arrest him.

Reality: It was only a pre-arbitration entry — not a criminal case.

After consultation, he negotiated, paid, and filed a CIBIL dispute.

Within 45 days, status changed to “Settled,” and his score improved from 590 → 705.

Lesson: Don’t panic, verify, and respond strategically.

What If You Already Settled but “Suit Filed” Still Shows?

This is common.

Many lenders forget to update CIBIL even after you’ve cleared dues.

Here’s what to do:

- Write to the lender’s grievance cell with proof of payment.

- If no response in 30 days, raise a CIBIL dispute with your documents.

- Mention: “Account paid and settled; kindly update from Suit Filed to Settled.”

- Track status through CIBIL dashboard.

Once resolved, your score will begin recovering within 60 days.

Legal Options if Lender Is Harassing You

Even if “Suit Filed” is genuine, lenders cannot harass, threaten, or defame you.

Your rights:

- They can’t call you after 7 p.m.

- They can’t speak to your employer or relatives.

- They can’t use abusive language or fake legal letters.

If they do:

- Record the calls.

- Report to your bank’s grievance cell.

- File a complaint with RBI or local police.

- Use SDS Harassment Tracker to maintain proof.

Suit Filed vs Recovery Agent Calls — Know the Difference

| Indicator | Real Case | Harassment Call |

|---|---|---|

| Case number | ✅ Exists | ❌ Fake threat |

| Legal notice | ✅ Issued by court | ❌ Whatsapp PDF |

| Lawyer signature | ✅ Registered advocate | ❌ “Collection Officer” |

| Verification | ✅ Check e-Courts | ❌ No record found |

How Long Does “Suit Filed” Stay on Record?

- Legal case: Until withdrawn or dismissed.

- CIBIL entry: 7 years from date of reporting.

- Post-settlement: Updated within 45–60 days of lender notification.

After that period, your credit report slowly normalizes — but only if no fresh defaults occur.

Can You Remove “Suit Filed” From CIBIL Permanently?

Yes — but only through the right dispute process.

Step-by-step:

- Confirm entry on CIBIL.com.

- Contact lender for written closure.

- Raise online dispute on CIBIL portal.

- Wait 30–45 days for verification.

- If rejected, re-raise with RBI Banking Ombudsman using your case ID.

Result: CIBIL updates the entry or flags it as “Resolved.”

What Happens After You Fix “Suit Filed”

Once the remark changes to “Settled” or “Closed”:

- Your score rises 50–100 points in 2 months.

- Loan eligibility resumes.

- Recovery agents stop calling.

- Peace of mind returns.

That’s why timely action beats panic every single time.

Related Concepts You Should Know

| Term | Meaning | Why It Matters |

|---|---|---|

| Default | Missed EMI | Leads to Suit Filed |

| Settlement | Partial payment accepted | Updates CIBIL |

| DPD | Days Past Due | Early warning indicator |

| Arbitration | Out-of-court resolution | Common for NBFCs |

| Legal Notice | Pre-suit step | Opportunity to respond |

Quick FAQ

1. Is “Suit Filed” a criminal case?

No, 99% are civil or arbitration cases. Only cheque-bounce cases under NI Act 138 are criminal.

2. Can I be arrested for “Suit Filed”?

No. Loan default isn’t a criminal offense. You can be sued for recovery, not arrested.

3. Can I remove “Suit Filed” from my report?

Yes, by settling or disputing it properly.

4. How long does it stay?

Up to 7 years unless removed earlier.

5. Can I get loans again?

Yes, once status changes to “Settled” or “Closed” and score improves.

Related Reading

If you’re dealing with a Suit Filed remark or related credit issues, these detailed guides will help you take the right next steps:

Final Thoughts

The term “Suit Filed” sounds terrifying — but once you understand it, it’s just a signal, not a sentence.

Most cases never reach court.

Many can be resolved through settlement, dispute, or negotiation.

The key is to verify first, act smart, and never ignore communication.

If you’re facing repeated calls, legal threats, or confusion over your report:

Talk to a professional. One correct step can save your future loans — and your peace of mind.

Stay informed. Stay calm. Stay in control.

About the Author

The author is a seasoned loan settlement consultant and strategist with years of hands-on experience in guiding borrowers through financial stress. He is the founder of Sharma Debt Solutions, where he has helped numerous clients resolve complex loan and credit issues with clarity and confidence.

As a content creator, he is dedicated to simplifying RBI guidelines, borrower rights, and settlement strategies into practical advice that anyone can act on. Known for his straightforward style, deep research, and borrower-first approach, he has built a reputation for providing solutions that are not just legally sound but also realistic for everyday people.