If you’re carrying a loan you can’t keep up with, or considering settling it early, you probably want to know: how much will I actually pay if I opt for settlement? That’s where a good loan settlement calculator comes in. In this article, I’ll show you what settlement means, how to calculate it, what impacts it has, and how to use a loan settlement calculator properly — India style.

What Is Loan Settlement & Why Use a Calculator

Loan settlement (also called one-time settlement, OTS) is when you negotiate with your lender to pay a lump sum amount which is less than the total outstanding loan (principal + interest + fees) to close the loan.

You might want to settle if:

- You’re in default or have missed several EMIs.

- You have financial strain (job loss, medical issue, business loss, etc.).

- You believe early settlement cost + impact will be lower than continuing with full interest payments.

A loan settlement calculator helps you estimate what that lump sum might be, how much interest you’d save, and whether it makes financial sense. It brings clarity before you start negotiation.

What Goes Into a Loan Settlement Calculator

To build or use a reliable loan settlement calculator, here are the key inputs and assumptions it must consider:

| Input | Purpose |

|---|---|

| Outstanding Principal Balance | The amount you still owe on the loan. |

| Accrued Interest / Penalties / Late Fees | Unpaid interest, late payment charges, penalty fees — these often balloon. |

| Settlement Discount Rate / Negotiation Percentage | The percentage lender may accept below total dues (negotiated). |

| Remaining Tenure / Scheduled EMIs | Helps compute how much interest you would have otherwise paid if not settled. |

| Lender Policy / Type of Loan | Some lenders are more flexible; secured loans might have different settlement terms. |

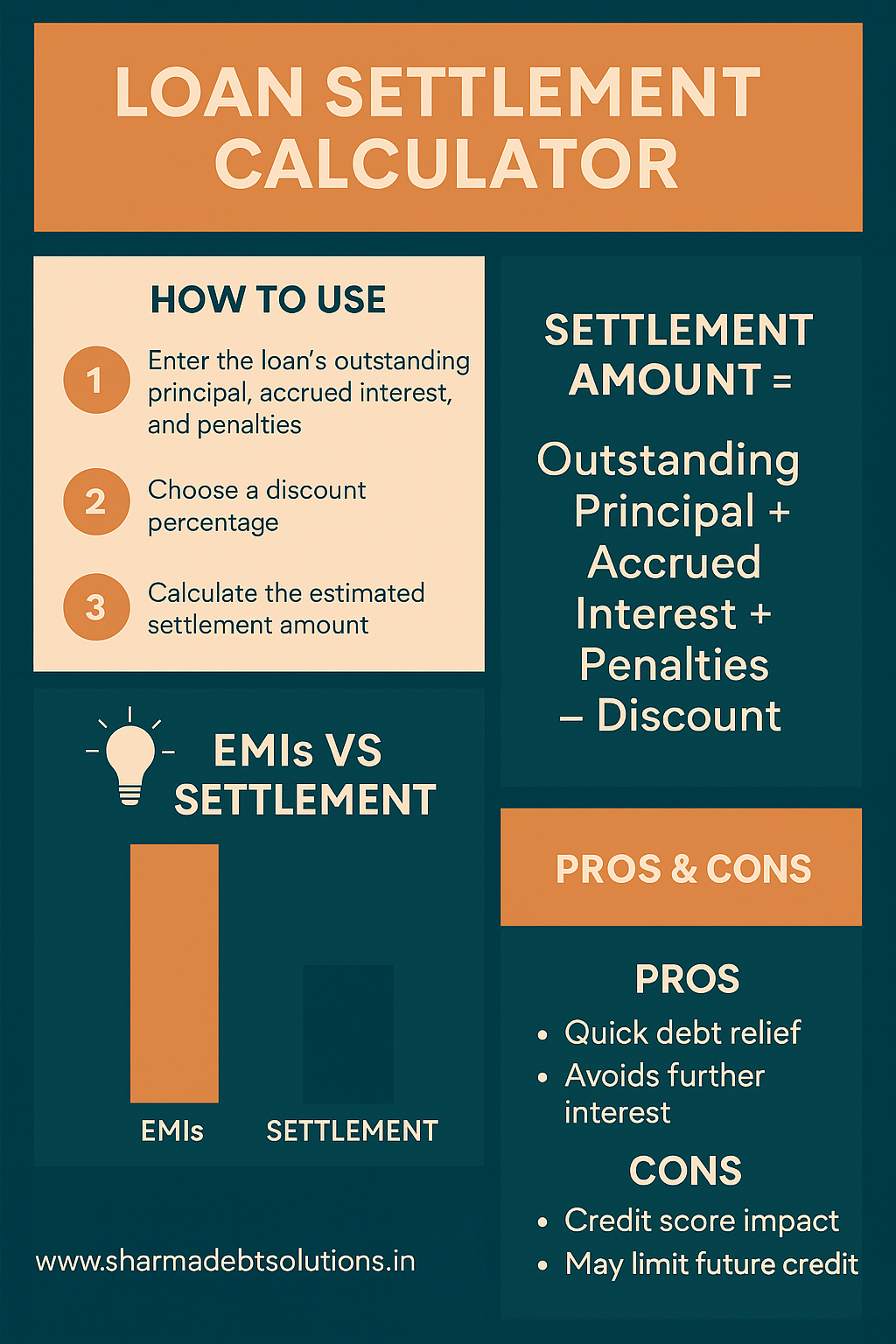

Formula / Method to Estimate Settlement Amount

There’s no single universal formula (lenders decide case-by-case), but here’s a simplified way to estimate with a calculator logic:

Settlement Amount Estimate = Outstanding Principal + Accrued Interest + Late Fees − Possible Discount

Where,

- Outstanding Principal = the principal remaining on your loan.

- Accrued Interest + Late Fees = interest and penalties accumulated so far.

- Possible Discount = what the lender might waive — often 10-50% of interest/fees or part of principal, depending on your situation.

You should also compare:

- Total Payable Without Settlement = sum of remaining EMIs (principal + interest) over full tenure.

- Interest Saved = Total Payable Without Settlement − Settlement Amount.

A loan settlement calculator would let you try different discount %s (20%, 30%, 40%) and show you how much you save.

Unsure What This Settlement Calculation Really Means?

This calculator provides an estimate based on common patterns. Every loan situation is different, and outcomes depend on multiple factors. If you want to understand what is realistically possible in your case, you may choose to discuss it further.

Please note: An initial discussion helps assess your situation at a high level. Detailed, case-specific guidance and clear next steps are provided through a paid case-clarity consultation.

No guarantees. No pressure. Just clarity to help you decide your next steps.

How Loan Settlement Works in India

- Lenders typically allow negotiation after you’ve defaulted for several months.

- They may require proof of hardship (income loss, medical bills, etc.).

- If you settle, the loan is reported as “settled” not “closed”, which negatively affects your credit score.

- Some lenders waive part of the interest or late fees, but principal is rarely written off unless the case is very serious.

For background, the Reserve Bank of India (RBI) has guidelines on loan repayment and settlement that explain how banks handle restructuring and settlements.

How to Use This Loan Settlement Calculator

- Get your latest loan statement showing outstanding principal, accrued interest + fees, and remaining tenure.

- Decide a discount percentage you want to test — 20%, 30%, 40%.

- Calculate:

Settlement Amount = Principal + Fees − (Discount × Fees/Interest portion). - Compare with the total you’d otherwise pay through EMIs.

- Decide whether the lump sum + credit impact is worth it.

Examples: Settlement Calculations

| Scenario | Details | Settlement Estimate |

|---|---|---|

| Scenario 1: Personal Loan | Outstanding principal = ₹2,00,000; accrued interest/fees = ₹40,000; remaining tenure = 12 months; expected discount = 30%. | Settlement = 2,00,000 + 40,000 − (30% × 40,000) = ₹2,28,000. Without settlement, full repayment = ~₹2,40,000. Saving = ~₹12,000. |

| Scenario 2: Auto Loan | Outstanding principal = ₹5,00,000; accrued interest/penalties = ₹1,00,000; tenure left = 24 months; expected discount = 25%. | Settlement = 5,00,000 + 1,00,000 − (25% × 1,00,000) = ₹5,75,000. Without settlement, total = ~₹6,90,000. Saving = ~₹1,15,000. |

Read more on: Personal loan settlement

Pros & Cons of Loan Settlement

Advantages

- Quick relief from debt pressure

- Avoids further interest and penalties

- May reduce payable amount significantly

- Helps avoid legal/collection escalation

Disadvantages

- Loan will show as “settled” in your credit report

- Negative impact on CIBIL / credit score (lasts up to 7 years)

- Harder to get new loans or credit cards soon after

- Negotiation may still result in paying most of the principal

Key Things to Check Before Settling

- Always get a written settlement agreement.

- Ask for a No Objection Letter / Settlement Certificate after payment.

- Check whether foreclosure charges apply.

- Ensure you can pay the lump sum on time — late payment voids the deal.

Sample Loan Settlement Calculator (How It Should Work)

A good tool should let you:

- Enter principal, interest/fees, discount %.

- Output settlement amount, full repayment amount, savings in ₹.

- Try different discount % scenarios (20%, 30%, 40%).

- Show a chart comparing EMIs vs settlement lump sum.

Impact on Credit Score

- Settlement marks the account as “settled” instead of “closed in full.”

- This remains on your credit report for years and lowers your score.

- You may still get loans later, but usually with higher interest and stricter terms.

When Settlement Makes Sense (and When It Doesn’t)

Good idea if:

- You’ve defaulted or are about to default.

- Paying EMIs fully is impossible due to financial hardship.

- You have funds available for a lump sum.

Bad idea if:

- You only missed 1–2 EMIs and can catch up.

- You need a clean credit report soon for a home/car loan.

- Lender is not offering meaningful discount.

FAQs

Q: What discount can I expect?

Usually 20-40% on interest/fees; principal is rarely reduced unless extreme hardship.

Q: Does settlement ruin my CIBIL score?

It lowers your score and shows a negative remark for up to 7 years.

Q: Can I negotiate before default?

Sometimes lenders allow hardship arrangements, but full settlements are usually offered after multiple missed EMIs.

Q: Is settlement legally safe?

Yes, if you get everything in writing and collect a settlement certificate.

Bottom Line

A loan settlement calculator is your financial reality check. It shows you what you’d pay if you settle today versus continuing EMIs. Use it to plan, negotiate better, and decide if settlement is worth the trade-off.