Loan moratorium Supreme Court rulings have left many borrowers in India confused and stressed. Are EMIs paused? Are recovery agents still allowed to call you? If you’re searching for clarity on what the Supreme Court actually said — and what it means for your loans — you’re not alone.

Thousands of borrowers are still trying to understand their legal rights and protections in 2025. This guide breaks it all down simply — plus how you can take real legal action if you’re being harassed.

You’re not alone. Thousands of borrowers across India are searching for clarity on the loan moratorium Supreme Court updates — especially when collection agents and banks are still chasing them for dues.

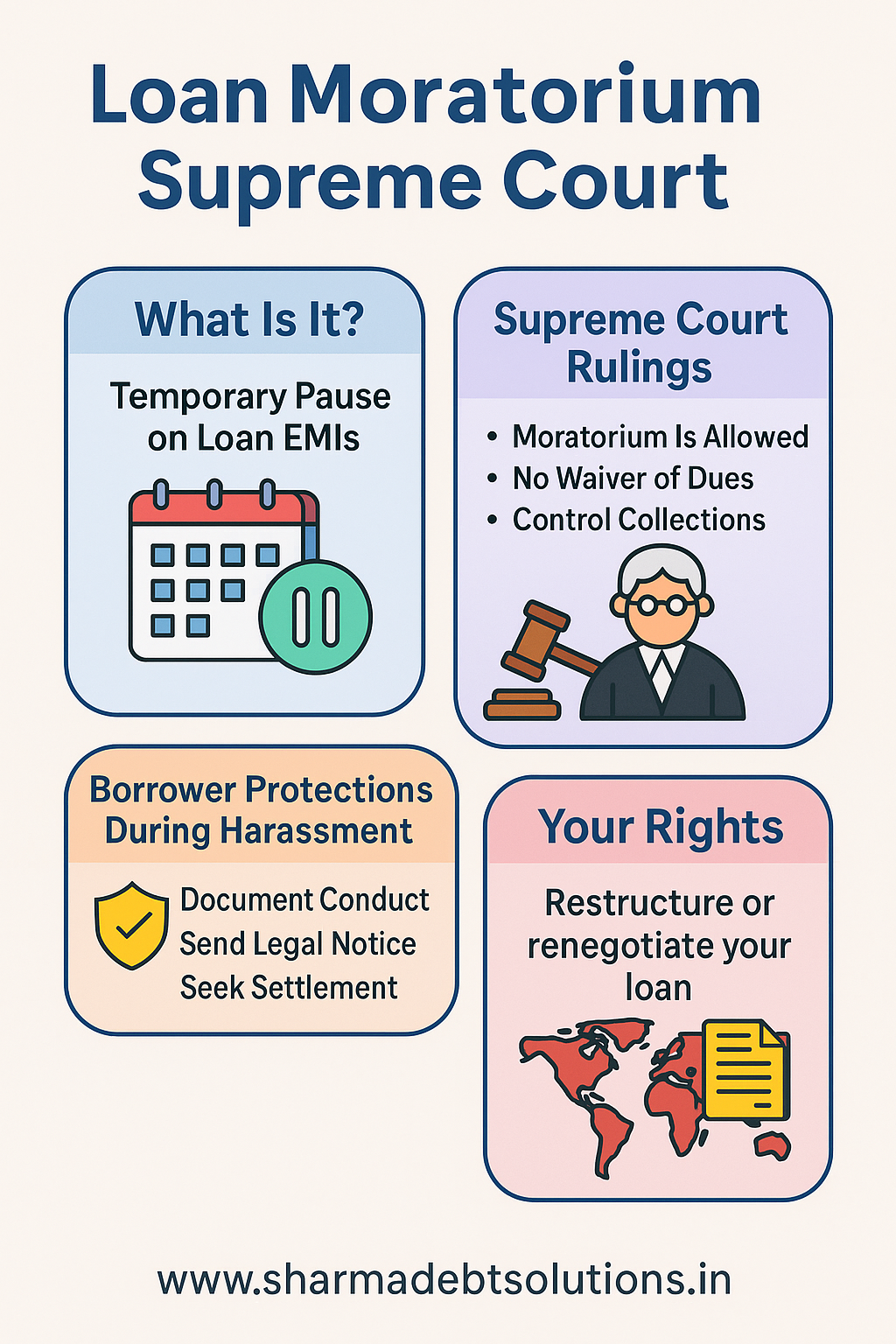

Infographic: Supreme Court rulings and borrower actions explained by Sharma Debt Solutions

In this guide, we break down the legal facts, recent court updates, and most importantly — how borrowers can use this information to protect themselves.

Table of Contents

ToggleWhat Is a Loan Moratorium?

A loan moratorium is a temporary pause on repayment of EMIs — usually announced during economic stress like COVID-19.

Back in 2020, the RBI had allowed a 6-month moratorium. But in 2025, there’s no such blanket pause. Still, many borrowers believe legal relief might exist. That’s where the Supreme Court comes in.

Supreme Court on Loan Moratorium – The Legal Timeline

Let’s simplify it:

1. March 2020 – RBI announces moratorium

Due to the pandemic, borrowers got a temporary relief from paying EMIs from March to August 2020.

2. October 2020 – Supreme Court steps in

Borrowers filed petitions demanding waiver of interest during the moratorium. The Supreme Court ruled partial interest relief for small borrowers.

3. 2021–2023 – Cases continue

Various industries and individuals sought more relief. Courts clarified that:

- Moratorium is optional, not automatic

- It does not waive your dues, just postpones payment

4. 2025 – What’s happening now?

No new moratorium has been announced in 2025. But borrowers continue to file cases for:

- Loan restructuring

- Harassment despite past moratorium

- Relief from aggressive collections

So, the keyword “loan moratorium Supreme Court” often trends during every new hearing or plea.

These ongoing petitions are keeping the loan moratorium Supreme Court debate alive well into 2025.

Despite the noise around the loan moratorium Supreme Court hearings, the ground reality is that most borrowers still feel stuck.

Is There Any Relief Right Now for Borrowers?

Let’s get real: There’s no blanket moratorium running in 2025. But that doesn’t mean you have no protection.

Here’s what you can do:

✅ Use past moratorium delays as defense

If banks/agents are threatening you despite having opted in 2020–21, you can raise it legally.

✅ Ask for restructuring

You can request your bank to restructure loans. RBI allows this on a case-to-case basis.

✅ Use SDS services for negotiation or legal response

At Sharma Debt Solutions, we help borrowers take control using RBI rules and real-world court updates that highlight how borrowers are pushing back to:

- Stop harassment

- Reduce EMIs

- Get settlement offers

You can read more about our full loan settlement process here.

Note: As of 2025, the Supreme Court is not directing banks to offer any fresh loan moratorium. Reliefs are now granted only on a case-by-case basis, either through approved restructuring or formal legal objections.

Tired of Begging for Restructuring?

If you’re being ignored or denied, stop harassing yourself. Restructuring often drags your loan longer and doesn’t reduce the burden. In many cases, it’s smarter to negotiate a one-time settlement — and close your chapter for good, even at 20%–30% of the total.

Common Myths Around Loan Moratorium & Court Rulings

“Supreme Court has canceled all loans”

Wrong. No such ruling has ever been passed. Moratorium means postponement, not waiver.

“I don’t have to pay anything now”

Wrong again. Your dues are still valid unless you restructure, settle, or legally dispute them.

“Recovery agents can’t call me if I took moratorium”

Partly true. If they harass, you can take legal action. But simply taking moratorium doesn’t erase the loan.

What Supreme Court Has Actually Said About Loan Moratorium

Let’s break it down:

| Aspect | Court’s Position |

|---|---|

| Moratorium legality | Allowed as per RBI circulars |

| Interest waiver | Partial relief for loans up to ₹2 crore |

| Collections during moratorium | Can’t be aggressive or threatening |

| Post-moratorium recovery | Legal, but not through harassment |

| Borrower rights | You can seek restructuring or legal help |

What You Should Do If You’re Being Harassed

- Document Everything

Log every call, message, or threat. Use our free Harassment Log Tool to document any calls that violate loan moratorium Supreme Court protections.. - Send Legal Notice

Don’t beg. Respond legally. We help clients send solid legal replies backed by Supreme Court and RBI guidelines. - Negotiate Smartly

Lenders are open to one-time settlements. We’ve negotiated settlements up to 60% less than total dues.

Facing EMI Harassment After the Moratorium?

You’re not alone. Sharma Debt Solutions has helped borrowers across India push back legally, reduce settlements, and reclaim peace of mind.

- Draft Legal Replies to Recovery Agents (Advocate Drafted)

- Get Phone/WhatsApp Support (Paid)

- Use Free Tools like the Harassment Log

Need personal help? Book a Consultation Now → 9106484927 (WhatsApp)

Legal Tools We Offer to Borrowers

| Tool | Purpose | Free/Paid |

|---|---|---|

| Harassment Log Tracker | Collect proof of agent calls | ✅ Free |

| Legal Notice Draft | Stop calls using RBI/Supreme Court logic | ✅ Free (via consultation) |

| Settlement Support | We help you negotiate with banks/NBFCs | ✅ Paid |

| Legal Tracker App | Document recovery pressure, prepare court-ready log | ✅ Free Trial |

Supreme Court Decision on Loan Moratorium: Your Takeaway

Don’t wait for the next breaking news. Most people Google “loan moratorium Supreme Court” hoping for a miracle.

Here’s the truth:

The court gives guidelines. The action is up to you.

If you’ve missed EMIs or are under pressure, don’t delay. Supreme Court rulings may give background relief, but you still need:

- A legal strategy

- Negotiation support

- And a clear action plan

That’s where SDS comes in.

FAQs on Loan Moratorium and Supreme Court

Is there a new moratorium in 2025?

No. There’s no active moratorium announced in 2025 as of now.

Can I stop paying EMIs due to financial trouble?

Not automatically. But you can apply for restructuring or consult our team for settlement advice.

What if I took the 2020 moratorium but still face harassment?

You can legally object. SDS can help you send notices and document your case.

Want Help With Your Loan Case?

At Sharma Debt Solutions, I personally work with a network of advocates to help borrowers facing harassment, legal pressure, or tough loan situations — credit card defaults, personal loans, BNPL traps, and more.

You won’t see courtrooms in my videos — but you will get real-world solutions built from real borrower cases.

- ✅ Consultation via WhatsApp

- ✅ Personalised Support For Your Case

- ✅ Legal Notices via Verified Advocates (If Needed)

Note: Sharma Debt Solutions is not a law firm and does not offer legal advice. Legal documents are handled through qualified independent advocates on a case-by-case basis.

Click to Chat Now on WhatsAppFinal Words

The Supreme Court has never promised “loan waivers.” But if you’re being harassed despite genuine efforts, you have rights — and we can help you use them.

Keep checking news updates, sure. But don’t sit helplessly waiting for relief. Take smart action today with expert support from SDS.

Authored by Mr. Sharma

Founder of Sharma Debt Solutions

Helping borrowers legally push back, settle smartly, and regain peace of mind — with support from trusted independent advocates when needed. For help, you can Message Sharma Debt Solutions on WhatsApp below: