Missing EMIs on your home loan is more than a financial hiccup — it’s the first step toward a legal process that can end with your property being repossessed. Every week at Sharma Debt Solutions, we hear the same anxious question: “What legal action will the bank take if I default on my home loan?”

If you’re in that position — this detailed guide explains exactly what happens under Indian law, step-by-step. You’ll learn what banks can do, what your rights are, and how to respond before it’s too late.

Table of Contents

ToggleUnderstanding Home Loan Defaulter Legal Action

A home loan defaulter legal action begins when a borrower fails to pay EMIs for several months and the account is classified as an NPA (Non-Performing Asset). From the bank’s perspective, the home you purchased isn’t just your shelter — it’s their security asset. When you default, they’re legally entitled to recover dues from that asset.

What counts as default

A default typically happens when three consecutive EMIs remain unpaid (around 90 days). The loan is then marked as an NPA. From this point, the bank shifts your file from “collections” to “recovery,” and that’s when legal notices start appearing.

Why banks take legal action

When a loan becomes an NPA, the bank’s income on that loan stops, while operational costs and provisioning requirements increase. To protect its balance sheet, the bank uses the SARFAESI Act — the Securitisation and Reconstruction of Financial Assets and Enforcement of Security Interest Act, 2002 — to recover its dues.

SARFAESI allows banks and NBFCs to:

- Issue a 13(2) demand notice.

- Take possession under 13(4).

- Sell or auction the property without going to court.

This is the core of home loan defaulter legal action in India.

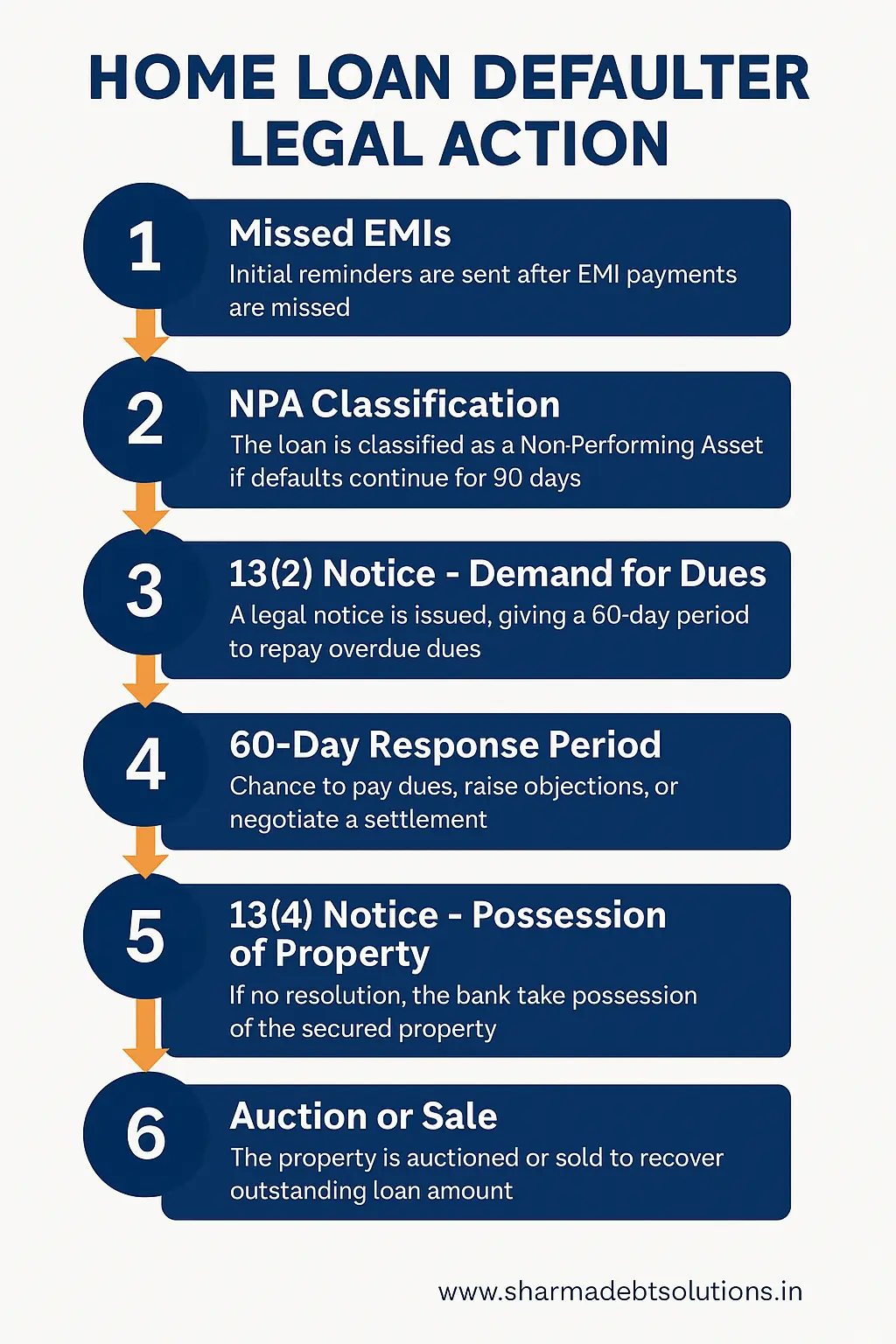

Step-by-Step Process of Home Loan Defaulter Legal Action

Understanding each phase helps you react correctly at the right time.

Step 1: Initial Missed EMIs

The first missed EMI triggers reminders — emails, calls, and sometimes SMS alerts. Your account may be marked SMA (Special Mention Account). You’ll likely get friendly reminders before it turns serious.

If you’re struggling due to job loss, health issues, or business slowdown, inform your bank immediately. Early communication can help you negotiate a moratorium or EMI rescheduling.

Step 2: NPA Classification

After 90 days of non-payment, the loan becomes NPA. The branch forwards your case to the stressed asset management department. They may offer last-minute restructuring, but if no payment is made, they prepare the SARFAESI file.

Step 3: 13(2) Notice — The Legal Beginning

Once your home loan is classified as NPA, the bank issues a Section 13(2) notice.

This is the formal beginning of home loan defaulter legal action.

The notice:

- States the outstanding dues.

- Gives you 60 days to clear the debt or object.

- Warns that the bank will take possession of the property if dues aren’t paid.

This is your first and most critical opportunity to act. Ignoring it means you’re silently allowing the bank to proceed legally.

Step 4: Your 60-Day Window to Respond

During this window, you can:

- Pay the overdue EMIs or negotiate a lump sum part payment.

- File a written objection to the bank (e.g., miscalculated dues, pending restructuring request, incorrect classification).

- Request a One-Time Settlement (OTS).

If the bank rejects your objection, they must communicate it in writing. That’s a procedural safeguard under SARFAESI.

Step 5: 13(4) Notice — Possession of the Property

If you fail to act within 60 days, the bank moves to the next phase — Section 13(4).

They take symbolic possession first — by pasting a possession notice on your property and publishing it in two newspapers.

If you still don’t cooperate, the bank applies to the District Magistrate (DM) under Section 14 for physical possession. The DM authorises local police to assist in handing over the property to the bank.

Once physical possession is taken, your home legally becomes the bank’s secured asset for recovery.

Step 6: Auction or Sale of the Property

After possession, the bank conducts a valuation and issues a 30-day public auction notice. They must:

- Publish it in newspapers and online.

- Specify reserve price, inspection date, and bid date.

If the property is sold and the sale amount exceeds your total outstanding, the balance must be returned to you. If the sale value is lower, the shortfall remains payable by you.

Step 7: Borrower’s Right to Appeal — DRT

Even after possession, you still have the right to challenge the bank’s action by filing an application under Section 17 before the Debt Recovery Tribunal (DRT) within 45 days.

However, to file this, you must deposit up to 50% of the demanded amount (sometimes reduced to 25% by the tribunal).

The DRT can:

- Review whether the bank followed due process.

- Grant a stay on sale.

- Order revaluation or set aside the action if rules were violated.

Borrower’s Rights During Home Loan Defaulter Legal Action

You’re not powerless during this process. Indian law provides several protections even after default.

Right to be heard

The 13(2) notice gives you a clear opportunity to present your side. You can file a reply with valid grounds — procedural errors, pending settlement, or RBI policy violations.

Right to fair valuation

If the bank undervalues your property before auction, you can object and demand revaluation.

Right to any surplus sale amount

If your house is sold for more than your debt and recovery cost, the bank must refund the excess amount.

Right to dignity and privacy

Recovery agents cannot harass or threaten you. RBI’s Fair Practice Code forbids unethical collection methods.

Right to approach DRT or High Court

If you believe the bank skipped procedure or violated your rights, you can approach DRT (after 13(4)) or, in exceptional cases, the High Court under Article 226.

Common Borrower Mistakes During Home Loan Defaulter Legal Action

- Ignoring the 13(2) notice:

This is the most fatal mistake. If you ignore the notice, you lose your strongest legal position. - Assuming the bank won’t act:

Many borrowers think, “It’s my self-occupied house, they won’t take it.” That’s false. Once it’s mortgaged, the bank can act under SARFAESI. - Waiting for the auction date to react:

Once the auction is announced, even DRT intervention becomes difficult. Always act during the notice stage. - Panicking or going silent:

Going missing from communication makes banks aggressive. Always stay reachable and professional — it builds a case for negotiation later. - Trusting unqualified advice:

Every case is unique — only a professional or SARFAESI expert can properly assess your situation.

How to Respond Strategically

At Sharma Debt Solutions, we guide borrowers every day through these same steps. Here’s the approach we recommend if you’re facing home loan defaulter legal action:

1. Assess Your Total Exposure

Get the exact figure from your lender, including overdue EMIs, interest, and charges. Compare it with your property’s market value to decide your best move — repayment, restructuring, or settlement.

2. Respond to 13(2) in Writing

Never ignore it. Even a short written objection gives you legal standing. We usually help clients draft clear responses that highlight procedural gaps or propose settlement terms.

3. Explore One-Time Settlement (OTS) Early

Banks often agree to OTS before auction because it saves them time and paperwork. If you can arrange a lump sum, it’s the fastest way to close the matter and save your credit score.

4. Avoid Civil Suits After 13(2)

Civil courts generally have no jurisdiction after SARFAESI is triggered (Section 34). Instead, focus on negotiation or DRT remedies.

5. Keep Communication Professional

Avoid emotional calls or informal messages. Keep records of all correspondence. Written communication is your evidence if things escalate.

Legal Consequences of Ignoring Home Loan Defaulter Legal Action

If you ignore notices and avoid the process entirely, you face:

- Property possession and auction

- Loss of property ownership

- Credit score collapse (usually below 550)

- Difficulty getting future loans or credit cards

- Possible legal proceedings for balance recovery

Once the bank recovers through auction, it can still pursue you for any remaining amount through DRT or civil recovery, depending on the loan size.

Illustrative Example

Mrs. K from Delhi had a ₹42 lakh home loan. She lost her job and missed six EMIs. The bank issued a 13(2) notice, which she ignored, thinking she could pay later. By the time she sought help, the bank had already taken possession.

The client filed a representation highlighting undervaluation, got a temporary stay from DRT, and negotiated an OTS where she paid ₹30 lakh through family support — saving her home from auction.

This shows how timing changes everything in home loan defaulter legal action.

FAQs About Home Loan Defaulter Legal Action

Can the bank seize my house without warning?

No. Under SARFAESI, a 13(2) notice with 60 days’ time is mandatory before any possession step.

What if I’ve paid most of the loan already?

Even if you’ve paid 80%, defaulting on remaining EMIs still allows the bank to initiate action. But since your outstanding is small, settlements are usually easier.

Can I stop the auction?

Yes — by paying dues or getting a stay from DRT. Once the sale deed is executed, stopping it becomes nearly impossible.

Does this affect my guarantor?

Yes. If you have a guarantor, the bank can proceed against their assets too.

What if I get a court injunction before 13(2)?

If you manage to obtain an injunction before 13(2), the bank must respect it until it’s vacated. But after 13(2), civil courts can’t interfere.

How Sharma Debt Solutions Can Help

At Sharma Debt Solutions, our mission is to guide borrowers through legal and financial recovery — ethically and effectively.

We assist clients at every stage of home loan defaulter legal action:

- Drafting replies to 13(2) notices.

- Negotiating OTS or restructuring before auction.

- Challenging wrongful possession or undervaluation at DRT.

- Helping clients restore credit scores post-settlement.

Our team combines practical experience, banking expertise, and legal insight. If you’ve received a notice or fear one is coming, act now. Early intervention can mean the difference between saving your home or losing it at auction.

WhatsApp: 9106484927 (Paid Consultation)

Let’s assess your case confidentially and help you take control before it’s too late.

Conclusion

Defaulting on your home loan is not the end — but ignoring it can be.

The home loan defaulter legal action process in India gives banks strong powers under SARFAESI, but it also gives borrowers clear rights and windows to respond.

If you act early — respond to notices, negotiate settlements, or challenge unfair steps — you can still protect your property and credit future.

At Sharma Debt Solutions, we help borrowers every day to turn panic into strategy. Remember, time and response are everything. Don’t wait for the auction notice — take control today.