If you’ve ever taken a personal loan, home loan, or business loan in India, you’ve probably come across the term foreclosure fee. But what exactly is the foreclosure fee meaning? Why do lenders charge it? And can you avoid paying it?

Let’s decode everything clearly. This is your ultimate, no-nonsense guide on foreclosure fee meaning in India, how it’s calculated, and how to make smarter repayment decisions.

Table of Contents

ToggleWhat Is Foreclosure Fee Meaning?

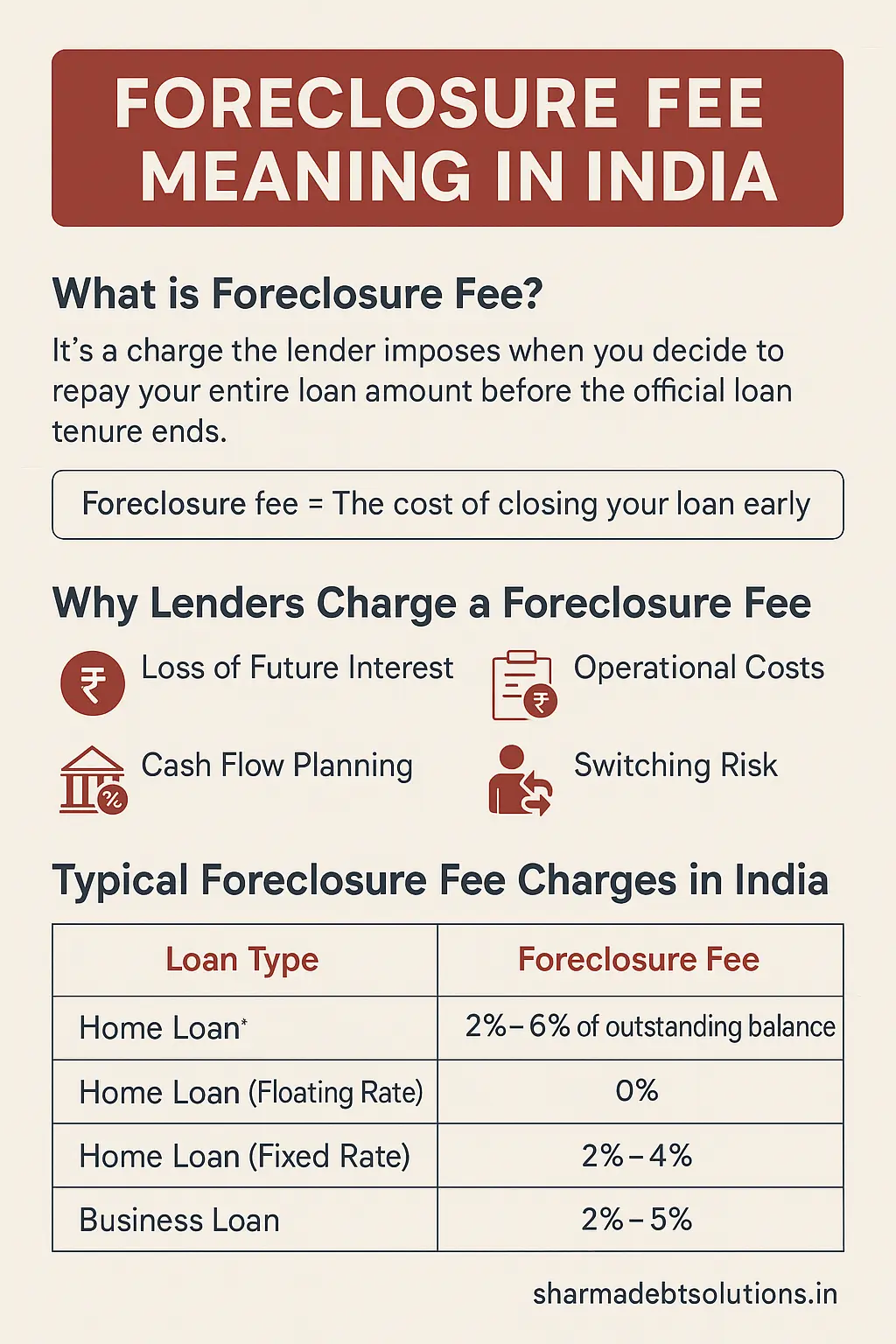

The foreclosure fee meaning is simple:

It’s a charge the lender imposes when you decide to repay your entire loan amount before the official loan tenure ends.

When you take a loan, the bank expects to earn interest for the full period. If you prepay it early, the lender loses future interest income. The foreclosure fee (also called a loan foreclosure charge) compensates for that loss.

In other words:

Foreclosure fee = The cost of closing your loan early.

So, when you hear foreclosure fee meaning, think of it as the price of freedom — the small amount you pay to become debt-free before time.

Why Lenders Charge a Foreclosure Fee

Lenders don’t impose foreclosure charges just to be difficult — it’s basic business math. Here’s why it exists:

- Loss of Future Interest:

Early repayment means banks lose the remaining interest they were supposed to earn. - Operational Costs:

Closing a loan early requires paperwork, record updates, and collateral release. That costs money. - Cash Flow Planning:

Banks plan their liquidity and lending cycles based on expected EMIs. Foreclosure disrupts this rhythm. - Switching Risk:

Many borrowers foreclose a loan only to shift to another lender (balance transfer). Foreclosure fees discourage that churn.

So yes, the foreclosure fee meaning lies in the lender’s need to balance profitability and liquidity.

Typical Foreclosure Fee Charges in India

Now let’s look at what these foreclosure charges actually cost you.

| Loan Type | Foreclosure Fee Rate | Details |

|---|---|---|

| Personal Loan | 2% – 6% of outstanding balance | Often allowed after 6–12 EMIs |

| Home Loan (Floating Rate) | 0% | RBI bans foreclosure fee for individuals |

| Home Loan (Fixed Rate) | 2% – 4% | Depends on lender |

| Business Loan | 2% – 5% | Usually post-lock-in period |

| Credit Card EMI | 2% – 5% + GST | Check your bank terms |

| Loan Against Property | 2% – 4% | Includes documentation release fee |

Example:

If your outstanding loan amount is ₹4,00,000 and the foreclosure fee is 3%, you’ll pay ₹12,000 as foreclosure charges.

This is why understanding foreclosure fee meaning is so important — it helps you plan whether early repayment actually saves you money.

Foreclosure Fee Meaning: Fixed Rate vs Floating Rate Loans

The meaning of foreclosure fee changes slightly depending on the type of interest rate your loan has.

- Fixed Rate Loan:

You pay the same interest throughout. Closing early directly affects the bank’s profit, so a foreclosure fee applies. - Floating Rate Loan:

Interest fluctuates with the market. RBI regulations prohibit lenders from charging foreclosure fees on floating-rate loans for individual borrowers.

If you hold a floating-rate home or personal loan, you can usually close it anytime — without foreclosure penalties.

When Foreclosure Fee Is Not Applicable

Here’s when you can legally and practically avoid foreclosure fees:

- Floating-rate home loans for individuals (RBI rule).

- MSME and small business loans with floating rates.

- Loans with zero foreclosure offer promotions.

- Post-lock-in period loans where lenders waive the fee after a fixed time.

Knowing these exemptions makes the foreclosure fee meaning more empowering than intimidating.

Lock-In Period and Its Impact on Foreclosure Fee

Most lenders add a lock-in period, meaning you can’t prepay or foreclose until a certain number of EMIs are paid.

Typical lock-in durations:

- Personal loan: 6 to 12 months

- Home loan: 12 to 24 months

- Business loan: Up to 24 months

If you try foreclosing before that, you’ll either be denied or charged a higher foreclosure fee. Always read your loan document carefully to know the lock-in clause.

Foreclosure Fee Calculation Example

The foreclosure fee calculation is straightforward:

Foreclosure Fee = Outstanding Principal × Fee Percentage

Example:

- Outstanding loan: ₹5,00,000

- Foreclosure rate: 3%

- GST: 18%

Fee = ₹15,000 + ₹2,700 (GST) = ₹17,700 total charge.

If you’re planning early repayment, calculate both your foreclosure fee and potential interest savings to see if it’s worth it.

How to Foreclose a Loan in India – Step-by-Step

- Review your loan terms:

Check if foreclosure is allowed and what percentage applies. - Ask for a foreclosure statement:

This includes total outstanding, interest till date, and foreclosure fee. - Make the payment officially:

Use online transfer or cheque, not cash. - Collect closure documents:

Get your No Dues Certificate, closure letter, and original documents if any. - Update your credit report:

Ensure your CIBIL reflects “Closed” or “Paid in Full”.

This method ensures the foreclosure process is clean and well-documented.

Foreclosure Fee Meaning for Different Loan Types

Let’s unpack the foreclosure meaning across loan categories:

1. Personal Loans

- Highest foreclosure fees (2%–6%).

- Often allowed only after 12 EMIs.

- Many fintechs now offer zero foreclosure after 18 months.

2. Home Loans

- Floating-rate home loans = No foreclosure fee.

- Fixed-rate loans = 2%–4% charges possible.

- Business or joint borrowers may still pay.

3. Business Loans

- Usually 2%–5%.

- Negotiable if you’ve maintained strong repayment history.

4. Credit Card EMI Loans

- 2%–5% foreclosure fee plus GST.

- Must call customer service to request closure.

5. Loan Against Property

- Foreclosure fee between 2%–4%.

- Make sure you get all title deeds and documents back.

Advantages and Disadvantages of Loan Foreclosure

✅ Advantages

- Becomes debt-free faster.

- Saves significant interest cost.

- Improves your credit utilization ratio.

- Increases long-term peace of mind.

❌ Disadvantages

- You pay foreclosure charges.

- Lose liquidity or emergency funds.

- Lose home loan tax benefits (if any).

- May not gain much if only a few EMIs remain.

Before foreclosing, calculate your net saving after including the foreclosure fee.

Foreclosure Fee vs Prepayment: The Real Difference

Borrowers often confuse prepayment and foreclosure.

Here’s the key difference:

- Prepayment = Paying part of your loan early. (You still continue EMIs, but tenure or EMI reduces.)

- Foreclosure = Paying the entire remaining loan and closing it completely.

Both help reduce interest, but foreclosure fees usually apply only when you close the entire loan.

Smart Ways to Reduce or Avoid Foreclosure Fees

Want to beat the system (legally)? Here’s how:

- Opt for Floating Rate Loans:

No foreclosure penalty in most cases. - Negotiate Before Signing:

Ask for reduced or waived charges after a fixed period. - Wait Until Lock-In Ends:

Avoid penalties by closing after the minimum EMI period. - Do Partial Prepayments:

Cut down interest cost without paying a full foreclosure fee. - Ask for a Fee Waiver:

Long-time borrowers or high-credit-score customers can often get it waived.

Understanding foreclosure fee meaning isn’t just theory—it’s your ticket to smarter negotiation.

Foreclosing a loan can slightly influence your credit history. To understand the connection in depth, read our detailed guide on does foreclosure affect CIBIL score

Foreclosure Fee Impact on Credit Score

Foreclosing a loan affects your credit report in subtle ways:

- Positive: Lowers total outstanding debt and improves creditworthiness.

- Neutral or Slight Dip: If you close your only active loan, your credit mix shrinks temporarily.

In general, foreclosure helps maintain a clean credit record if done correctly with documentation.

RBI Guidelines on Foreclosure Fees in India

The Reserve Bank of India (RBI) has made clear rules to protect borrowers from unfair foreclosure charges:

- No foreclosure fees on floating-rate loans for individual borrowers.

- Applies to home loans, consumer loans, and education loans.

- Fixed-rate or commercial loans may still attract charges.

- Borrowers can complain to the banking ombudsman if wrongly charged.

These RBI rules make foreclosure fee meaning in India more borrower-friendly than ever.

The Reserve Bank of India (RBI) has issued clear rules to protect borrowers from unfair foreclosure charges. According to recent RBI guidelines on loan foreclosure charges, banks and NBFCs cannot impose fees on floating-rate loans for individual borrowers.

When Should You Actually Foreclose a Loan?

Foreclosing a loan early is smart only if:

- Your interest rate is high (10%+), like personal loans.

- You’ve cleared at least 50% of tenure.

- You have stable cash flow and an emergency fund.

- The foreclosure fee is smaller than the interest you’ll save.

But don’t foreclose if:

- You’ll lose tax benefits.

- Your loan has only a few EMIs left.

- You’d deplete your savings.

In short, the right time to foreclose is when interest savings outweigh the cost of the foreclosure fee.

Quick Checklist Before Foreclosure

☑️ Check your foreclosure clause and lock-in period.

☑️ Request a foreclosure quote from your lender.

☑️ Compare interest saved vs fee payable.

☑️ Keep emergency savings untouched.

☑️ Get a written No Dues Certificate.

☑️ Verify CIBIL update after closure.

This checklist ensures you handle foreclosure like a pro.

Conclusion

The foreclosure fee meaning in India is straightforward: it’s the cost of closing your loan before its official end date. Typically, foreclosure charges range from 2% to 6% of your outstanding loan balance, depending on the loan type and lender.

However, with RBI’s borrower-friendly rules, many floating-rate loans are now free from foreclosure penalties.

Before taking action, analyze your total interest savings, liquidity needs, and applicable foreclosure fee. Sometimes it’s smarter to continue EMIs and invest your money elsewhere.

But if the math supports it — close that loan confidently, collect your closure certificate, and enjoy the freedom of being debt-free.

Now you know the foreclosure fee meaning in India, how it works, and how to use that knowledge to your advantage.