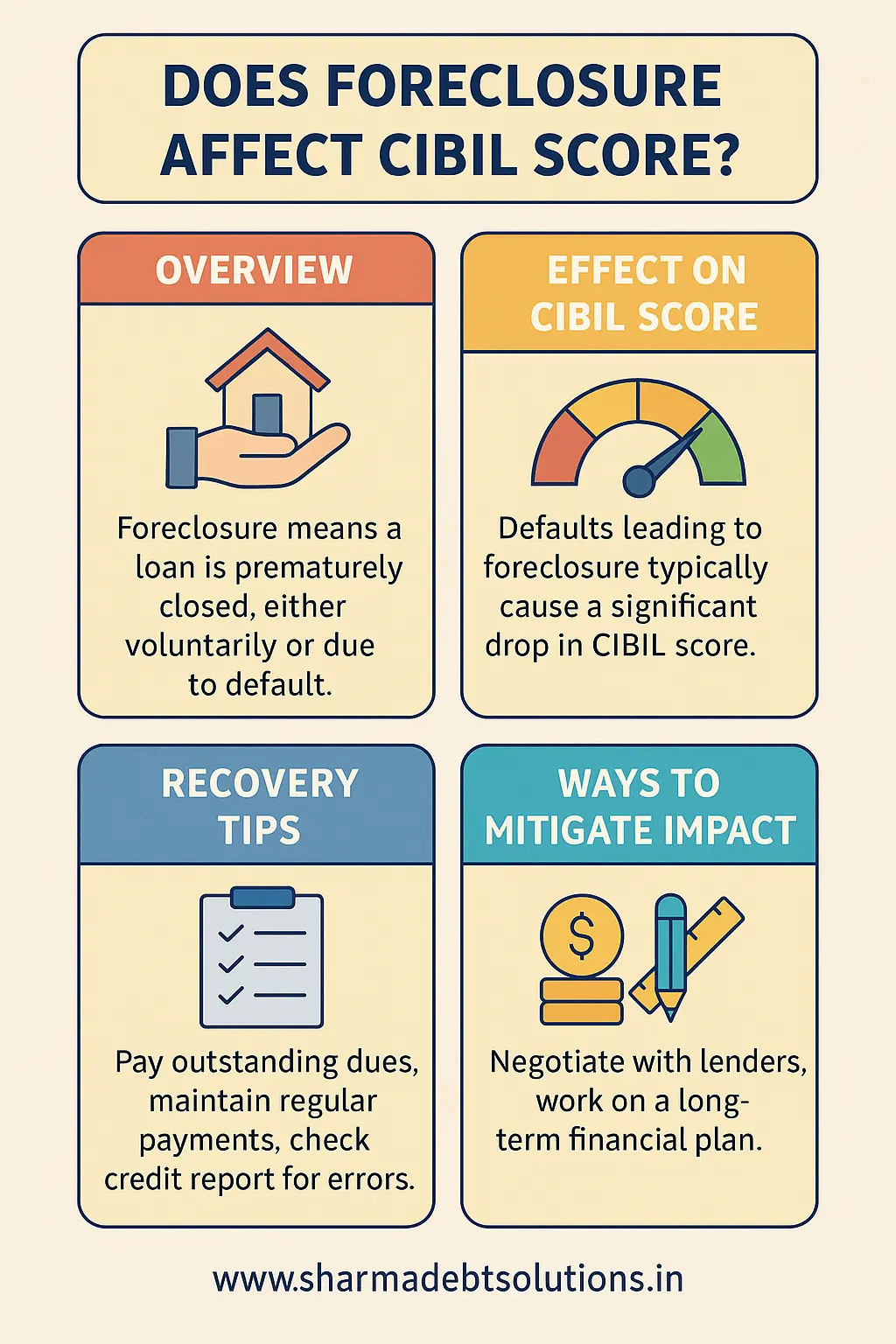

If you’ve ever searched for does foreclosure affect CIBIL score, you’re not alone. Whether it’s a home loan gone off track, a car loan you’re struggling with, or simply a decision you’re weighing, the question matters. This article breaks down if foreclosure affect CIBIL score, what the impact can be, and how you can manage the situation smartly—especially in India.

Table of Contents

ToggleWhat Foreclosure Really Means — And Why It Matters

In India, foreclosure has a few different meanings depending on the context. If you’re wondering whether foreclosure affects your CIBIL score, the exact meaning of “foreclosure” for your situation is critical.

Foreclosure often refers to paying off the remaining loan early—before the original tenure ends. Sometimes it also means the lender takes back the asset (in case of secured loans) because of default, and closes your loan account. The difference between pre-closure, settlement and foreclosure by default is huge when you’re considering does foreclosure affect CIBIL score.

- Pre-closure (voluntary early repayment): You decide to clear the whole loan earlier than scheduled. This is typically fine and may even reflect well if done after a consistent repayment history.

- Settlement (partial payment after default): You negotiate to pay less than what’s owed because you’ve missed EMIs. This is a major negative factor when assessing does foreclosure affect CIBIL score.

- Foreclosure due to default: The lender steps in, takes action, perhaps repossess asset, and closes the account. This is the kind of event that often answers the question “does foreclosure affect CIBIL score” with a clear “yes—and significantly”.

Why does this matter? Because when you ask “does foreclosure affect CIBIL score”, the answer is not uniform—it depends on what type of foreclosure you have experienced or are planning to experience.

Speak to an Expert in 3 Minutes

Need expert help to handle foreclosure or improve your CIBIL score?

Book a one-on-one consultation with a CIBIL expert today.

Fee will be displayed on the next page

Book NowUnderstanding the CIBIL Credit Score Mechanism

Before diving into the core question—does foreclosure affect CIBIL score—it helps to understand what factors contribute to a CIBIL credit score.

Your CIBIL score (which ranges roughly between 300 and 900) is influenced by:

- Your repayment history (how timely your EMIs have been)

- The types of credit you use (secured loans, unsecured loans, credit cards)

- How long your accounts have been active

- How much of your available credit limits you’re using

- How many new credit enquiries or new accounts you open

When you ask does foreclosure affect CIBIL score, you’re really asking: how does this event disturb these factors? Let’s see.

- Repayment history: If foreclosure follows missed payments, that history is negative.

- Credit type and tenure: Closing a loan early reduces the tenure/age of your loan account, which can affect your “older account” value.

- Credit mix: If you had a large secured loan and it’s now closed (or terminated in default), the mix of active accounts changes.

- Recent credit behaviour: A foreclosure marks a major change, and credit bureaus place weight on recent events when assessing risk.

So yes—does foreclosure affect CIBIL score? It certainly can, because it interfaces with several of the core scoring factors.

Does Foreclosure Affect CIBIL Score? The Real Impact

Let’s answer the key question directly: does foreclosure affect CIBIL score? The answer is yes—but how, and how much, depends on the details.

When the impact is minimal

If you voluntarily pay off your loan early (pre-closure) after a healthy repayment history, your account is closed “clean” and shows no missed payments. In such a case the question “does foreclosure affect CIBIL score” is answered with “not significantly”. The account is closed, you paid, and you didn’t default. The only downside might be slightly reduced length of credit history (your loan closed early). If you have other accounts, this one event is small in impact.

When the impact is major

If foreclosure or settlement happens because you missed EMIs, the lender closes the account prematurely, maybe repossessing collateral, and your report shows “foreclosed” or “written off”. Here, the question “does foreclosure affect CIBIL score” is answered with a clear “yes—and badly”. The negative remark remains visible for several years, your score falls, and lenders see you as higher risk.

Factors that influence how badly it affects you

- How many EMIs you paid before foreclosure. If you had a long history of timely payments, the damage is less.

- The type of loan: a big home loan foreclosure hits harder than a small personal loan foreclosure.

- What your credit profile looked like before the foreclosure. If you already had strong history, you recover faster.

- What you do after the foreclosure: if you start paying other obligations timely, keep utilization low, and rebuild history, the damage fades.

How long does the impact last?

Typically, the negative remark (settled/foreclosed/written off) remains visible on your report for up to 7 years (depending on bureau and policy). During that period, lenders will see it. The question “does foreclosure affect CIBIL score” therefore includes timing: yes, it affects you, but the effect reduces over time if you act right.

How to Mitigate the Damage & Rebuild After Foreclosure

If you are thinking: “does foreclosure affect CIBIL score in my case?” and you either foresee a foreclosure or have already experienced one—it’s vital to act. Here are practical steps.

1. Determine the type of history you have

Check with your lender: is your loan closure “Closed – No Dues”, “Settled”, “Foreclosed”, or “Written Off”? If you have not yet closed, find out how it will be reported. The answer to “does foreclosure affect CIBIL score” depends heavily on this status.

2. Get proof of closure or settlement

Once the account is cleared or finalised, make sure you have documentation: closure letter, NOC, final settlement certificate. Verify that the lender has reported proper status to the credit bureau. Mistakes here often make the impact worse, so get it sorted.

3. Monitor your credit report soon after this event

Download your CIBIL report (and from other bureaus if needed) 30-60 days after closure. Check how the account is marked. If you are seeing incorrect status (for example “Outstanding balance” or wrong remarks), raise dispute. Once you answer “does foreclosure affect CIBIL score”, you’ll see the result of this entry in your report.

4. Maintain and prioritise other credit obligations

If you have credit cards or other loans still active, keep paying on time. One missed EMI elsewhere right after a foreclosure can make your profile look worse. Show that you can handle remaining debts responsibly.

5. Reduce credit utilisation ratio

Even if you’re closing loans, you may still have credit cards or existing limits. Keep usage low (ideally under 30-40%). Since one of the scoring factors is utilisation, doing this supports your answer to the question “does foreclosure affect CIBIL score”—you’re showing responsibility.

6. Maintain some active credit lines

If you’ve closed all accounts, your profile may become too “thin”. On the flipside, having some small active loan or credit facility (even if you don’t fully need it) provides history. A small, responsibly managed account helps when you rebuild.

7. Be patient and focus on consistency

Just because you’ve had a foreclosure doesn’t mean you’re stuck forever. The long-term answer to “does foreclosure affect CIBIL score” is that the effect diminishes with time and good behaviour. Track your score quarterly, and mark how it improves.

Related Guides on CIBIL & Legal Impact

Before You Opt for Foreclosure — Think Ahead

If you haven’t yet foreclosed and you’re asking whether foreclosure affect CIBIL score, pause and consider carefully. Here are things to evaluate.

- Will you need a major loan (home, car, business) in the next 12-24 months? If yes, you might keep the loan running a while longer to maintain history before closing early.

- How many EMIs have you paid so far? If you’re near the start of the tenure and payment history is short, closing early might reduce your credit age and impact your “does foreclosure affect CIBIL score” outcome.

- Do you have emergency savings left after making a lump-sum closure? Financial stability matters for credit profile.

- Have you checked pre-payment or foreclosure charges with your lender? Sometimes costs outweigh benefits if your score takes a hit.

- Have you planned for your next credit needs? If you need new credit soon, and a foreclosure will downgrade your standing, you might delay.

- Has the lender confirmed how the account will be reported to the bureau? Verify that it will say “Closed – No Dues” rather than “Settled”.

The better you prepare before acting, the better your answer to “does foreclosure affect CIBIL score” will be in your favour.

How Lenders View You Post-Foreclosure

When you apply for credit after a foreclosure, lenders will assess not just your score but your full profile. If you’ve wondered does foreclosure affect CIBIL score badly enough to rule out loans, here’s what they check.

- How recent the foreclosure was: older events weigh less.

- Was it voluntary or forced: lenders want to see you weren’t pushed into closure due to default.

- Your income, employment stability, and existing debt burden: even if you have a foreclosure history, you can still qualify for loans if these other factors are strong.

- Whether you have other clean credit lines: current performance matters.

- How you explain the foreclosure: transparency can help.

So yes—the answer to does foreclosure affect CIBIL score is “yes”, but it doesn’t mean “no new credit forever”. With clean behaviour and time, you can still qualify for good loans.

Common Situations and What They Mean

Case A: You took a home loan, paid EMIs for seven years with no misses, then you choose to repay early.

In this case, you’re asking “does foreclosure affect CIBIL score?” But the answer here is mild—your score may dip slightly for shorter tenure, but overall your strong repayment history means you don’t suffer much.

Case B: You took a car loan, missed several EMIs in year three, the lender repossessed vehicle and foreclosed the loan.

Here your query “does foreclosure affect CIBIL score?” leads to a clear “yes—major impact”. You have negative history, short remaining tenure, and forced closure. Rebuilding will be critical.

Case C: You took a small personal loan, paid six EMIs and then paid the outstanding in full early.

You ask “does foreclosure affect CIBIL score?” but technically you’ve done a voluntary closure. The impact might be minor; your repayment history is short but clean. The main area to watch is your history length and credit mix going forward.

Myths vs Facts About Foreclosure and CIBIL Score

Myth: “If I foreclose, I will never get a loan again.”

Fact: While the event impacts your credit profile, it does not permanently bar you from new loans. The answer to does foreclosure affect CIBIL score is yes—but with effort you can recover.

Myth: “Pre-closing means instant boost in score.”

Fact: Only if you had good repayment history. Otherwise, closure too soon may reduce credit age and impact longer-term score. That means your “does foreclosure affect CIBIL score” question could go south if you act without strategy.

Myth: “The foreclosure entry disappears after one year.”

Fact: Negative entries can remain visible for up to 7 years in many credit-bureau systems. So the damage from foreclosure lingers, but diminishes over time—your “does foreclosure affect CIBIL score” outcome improves gradually.

Final Thoughts

So when you ask does foreclosure affect CIBIL score, be confident in this answer: Yes — but it depends on how, why and when the foreclosure happens, and what you do afterwards.

If you voluntarily close a loan after steady payments, the hit is minimal and manageable. If you face forced foreclosure because of defaults, the impact is bigger but not irrevocable. The main difference is in your actions.

What you do today matters: check how your account is reported, keep other loans healthy, maintain credit utilisation, monitor your score, and rebuild patiently. Your credit score is a living number—it rises and falls based on behaviour, not just past mistakes.

At Sharma Debt Solutions, we believe that understanding your credit profile and making informed decisions is the best way to ensure your future borrowing remains strong, even if a foreclosure has impacted you.