Credit card debt has quietly become one of the biggest personal finance challenges in India. It doesn’t strike like a sudden storm—it grows slowly, silently, and painfully. One delayed payment becomes two, interest compounding turns manageable dues into mountains, minimum payments feel endless, and before you know it, your financial life feels hijacked.

If you are stuck in this cycle, you are far from alone. Millions of Indians enter the same debt spiral every year. But very few know the actual tools available to break out of it.

One of the most powerful tools—when used correctly—is credit card settlement in India.

Credit card settlement is a strategic, structured negotiation where you pay a portion of your outstanding dues, and the issuer agrees to close the remaining balance. It brings relief, but it must be done intelligently, safely, and with a long-term plan.

This is NOT just a “pay less and move on” strategy.

It is a delicate balancing act involving timing, documentation, negotiation strategy, financial psychology, and understanding how banks and recovery departments think.

Most people approach credit card settlement blindly, emotionally, and with zero strategy—leading to bad deals, unnecessary stress, and long-term damage.

This guide is your blueprint to avoid all that.

What you’re about to read is the most complete and accurate expert guide to credit card settlement—tailored for real Indian users, real Indian card issuers, and real financial conditions in 2026.

Let’s begin.

What Credit Card Settlement in India Really Means

Credit card settlement allows you to close your outstanding dues by paying less than the total amount you owe. It is a compromise, not a waiver, and not a discount out of generosity. The issuer agrees because recovering the full amount is unlikely, especially once you’ve defaulted.

It typically works like this:

- You owe a certain amount

- You negotiate to pay a portion

- The issuer writes off the remaining balance

- The account is closed as “Settled”

This is a legal and recognized method of resolving unmanageable debts.

But it also comes with consequences:

- Your credit report will show “Settled”

- Your credit score may drop temporarily

- You may face difficulty getting loans for a while

Yet, in many situations, this is still far better than staying trapped in debt for years.

Settlement is not the enemy. Uncontrolled debt is.

Why Credit Card Settlement in India Is Becoming Increasingly Common

India’s consumer credit ecosystem has changed rapidly over the last decade. With easy credit limits, instant approvals, BNPL, unsecured loans, and increased online spending, millions are exposed to the risk of debt traps.

Here’s why more people are turning toward settlement:

High interest rates

Interest rates of credit cards in India can exceed 35 to 42 percent annually. With compounding, the actual burden becomes overwhelming.

Penalty charges

Over-limit fees, late payment charges, and multiple taxes can cause dues to double within months.

Single-income dependency

A majority of households depend on one salary. Even a small disruption—layoffs, medical issues, business losses—creates immediate repayment difficulty.

Improper usage of multiple cards

Rotating dues between cards or using one card to pay another creates a dangerous snowball effect.

Recovery pressure

Calls, messages, emails, home visits—emotional pressure eventually leads people to look for closure.

Learn how to stop recovery agent harassment and protect your family’s peace.Failure of EMI conversions

Many people convert dues into EMI, but then those EMIs also become unpayable.

Lack of financial awareness

People don’t truly understand credit utilization, compounding, interest slabs, or the penalties of missing payments.

For official guidance on customer rights and dispute resolution, you can refer to the Reserve Bank of India’s Ombudsman Framework .

Credit card settlement in India is no longer rare. It is a mainstream, practical solution when financial stability breaks down.

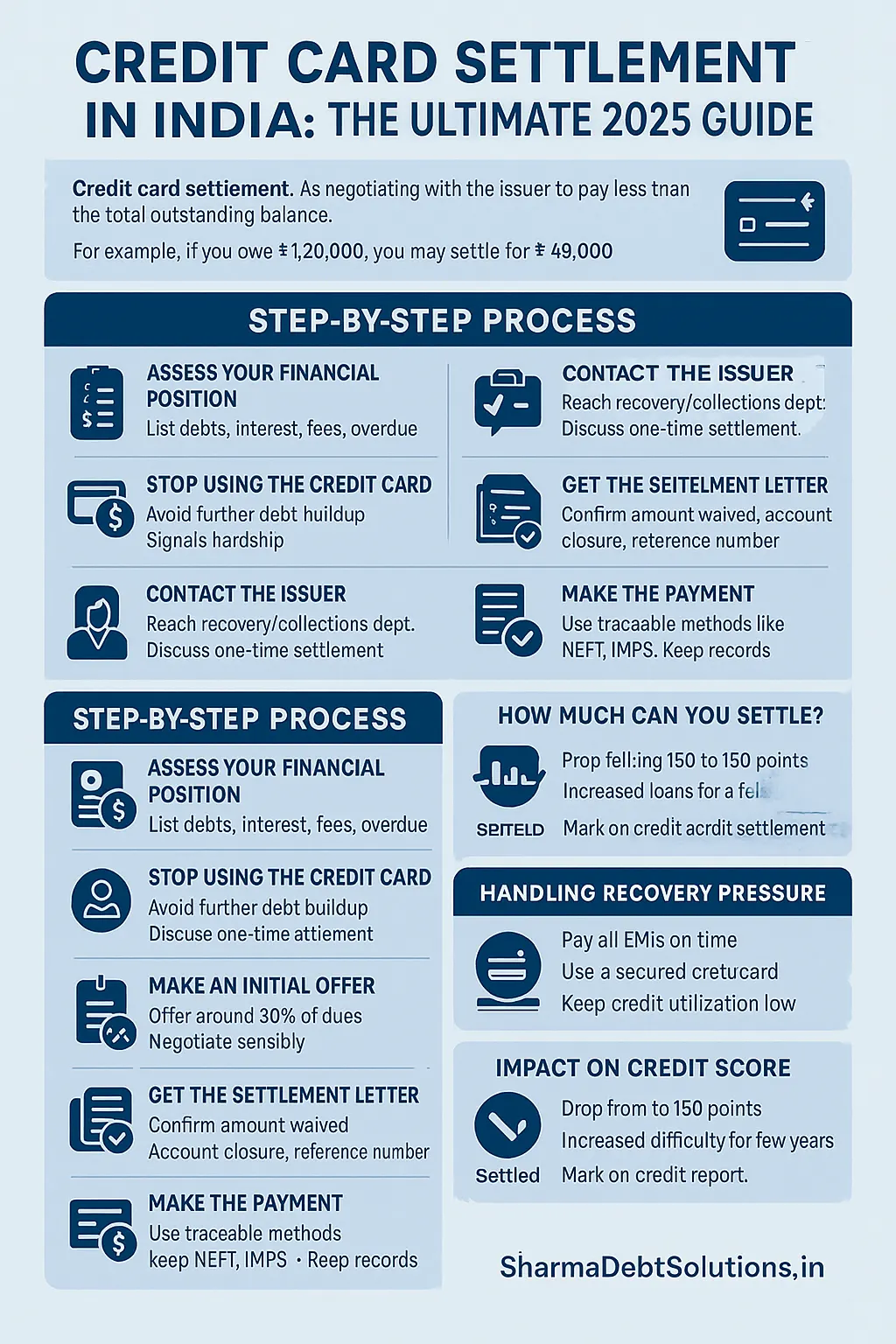

Step-by-Step Process of Credit Card Settlement in India

Here is the full, detailed, exact process—used by banks, recovery teams, and Indian consumers who’ve successfully settled their dues.

Step 1: Assess Your Financial Position Honestly

Before starting negotiation, list:

- Total outstanding dues

- Principal amount

- Interest charged

- Late fees

- Over-limit charges

- GST on penalties

- Days overdue

- Any legal notices

- Whether recovery agents are involved

- Your real repayment capacity

This clarity is crucial. It stops you from negotiating blindly.

Step 2: Stop Using the Credit Card Immediately

Continued card usage signals:

- You still have financial ability

- You are not in real hardship

- You may be hiding income

Using the card kills your negotiation leverage completely. Stop all spending before you begin.

Step 3: Contact the Issuer’s Recovery or Collections Department

This is where settlement begins. You can initiate through:

- Recovery representatives

- Collections officers

- Customer support escalation channels

Speak calmly:

“I am facing a financial difficulty and I’m unable to continue full payments. I want to close this account responsibly through a one-time settlement. I can arrange a limited lump sum amount.”

This shows sincerity and seriousness.

Step 4: Make an Initial Settlement Offer

In India, a general rule of thumb is:

Start with around 30 percent of the total outstanding.

Example:

Outstanding = ₹1,20,000

Initial offer = ₹35,000 to ₹40,000

Issuers will usually counter with:

- 40 percent

- 50 percent

- 60 percent

Or they may propose structured settlement:

- 40 percent now

- 20 percent next month

Your goal is to remain calm and negotiate sensibly.

Step 5: Negotiate with Strategy, Not Emotion

Smart negotiation can reduce your settlement by tens of thousands.

Key negotiation levers:

- Job loss

- Pay cuts

- Business slowdown

- Medical expenses

- EMI burden

- Single-income household

- Financial emergency

Issuers prefer collecting something now rather than chasing full repayment later, especially if you are overdue by 90–180 days.

This is your leverage.

Step 6: Demand the Settlement Letter Before Paying

This is the most important legal protection you have.

Your settlement letter must include:

Download ready-to-use templates for settlement letters, complaint emails, and more.- Final settlement amount

- Due date of settlement

- Confirmation that remaining balance will be waived

- Confirmation that no legal or recovery action will follow

- Confirmation of account closure after payment

- Reference number

- Authorized officer’s signature

Never, under any circumstance, pay without a settlement letter.

Step 7: Pay Through Traceable, Documented Methods Only

Acceptable methods:

- UPI

- NEFT/IMPS

- Cheque

- Online payment portal

Keep:

- Screenshots

- Transaction receipts

- Bank statements

- Email confirmations

Every document is important and must be stored permanently.

Step 8: Collect a No-Dues Certificate

After making the settlement payment, request:

- No dues certificate

- Closure confirmation

- Final statement showing zero balance

- Documentation of settlement status

These protect you from future misunderstandings or recovery attempts.

How Much Can You Realistically Settle For in India?

Actual settlement percentages vary by:

- Overdue period

- Negotiation skill

- Issuer’s internal policies

- Economic climate

- Account age

- Your financial condition

Here is a realistic breakdown based on trends in India:

20 to 30 percent

For very old accounts or severe hardship cases.

30 to 40 percent

Most common range for average Indian consumers.

40 to 60 percent

When the issuer feels partial repayment is possible.

60 to 80 percent

Common if negotiation is weak or overdue period is short.

Settlement is both an art and a science.

Factors That Influence Your Settlement Percentage

Days overdue

The older the default, the more flexible the settlement.

Hardship demonstration

Issuers respond better to genuine, calm explanations.

Lump-sum availability

Immediate payment creates powerful leverage.

Internal write-off timing

Accounts nearing charge-off stage get better settlement offers.

Recovery stage

After multiple recovery failures, settlement becomes attractive for the issuer.

When Credit Card Settlement in India Is the Right Choice

Opt for settlement when:

- Repayment is impossible

- Dues are doubling every month

- Recovery calls are frequent

- Legal notices have begun

- You want a clean exit

- EMI conversion is not enough

- Stress is impacting your mental health

- You can arrange a lump-sum amount

- Family responsibilities demand closure

Settlement in such cases is not a failure—it is survival.

Want to Discuss Your Credit Card Settlement Case Personally?

If you are confused about how to negotiate, what amount to offer, or how settlement will impact your credit score, you do not have to figure it out alone. You can speak with our team on WhatsApp and understand the options before you take any step.

Chat with Us on WhatsAppNo false promises. We help you understand what is realistically possible in your situation.

When You Should Avoid Settlement

Avoid settlement if:

- You can repay soon

- Your outstanding is small

- You need a major loan within a year

- Your job demands a clean credit profile

- You can restructure through EMI

- You want to avoid a settlement remark

In these cases, repayment or restructuring is better.

Get long-term debt support and strategy with our SDS Gold Membership.Impact of Credit Card Settlement on Credit Score

Your credit report will reflect one of the following:

- Settled

- Settled – Closed

- Account Closed – Settled

This indicates incomplete repayment.

Score impact

Typically reduces your score by 50 to 150 points.

Duration

The remark may remain for several years.

Recovery

With disciplined behavior, you can fully rebuild within 12–24 months.

Settlement is a short-term dent and a long-term relief.

How to Rebuild Credit After Settlement

Follow this structured recovery plan:

Pay all existing EMIs on time

Even a one-day delay hurts.

Reduce credit utilization

Ideally stay under 30 percent of limits.

Maintain older accounts

Long-standing accounts add stability.

Avoid applying for new credit immediately

Wait at least six months.

Use a secured credit card

A great credit rebuild tool.

Review your credit report regularly

Check every three months.

Recovery is easier than most people think.

Advanced Negotiation Strategies for Credit Card Settlement in India

These techniques can reduce your settlement percentage dramatically.

Time your negotiation

Best settlement flexibility comes between 90 to 180 days overdue.

Be calm

Emotional outbursts weaken your leverage.

Use silence strategically

After making an offer, stay quiet.

Give a specific number

Specific offers sound more genuine.

Offer immediate payment

Issuers love certainty.

Avoid new loans during negotiation

Issuers track your profile.

Stand your ground

Patience brings better offers.

Mistakes That Hurt Settlement Results

Avoid these:

- Using the card during settlement

- Paying without receiving a settlement letter

- Accepting the first counteroffer

- Speaking emotionally instead of logically

- Sharing unnecessary financial documents

- Settling too early (less than 60 days overdue)

- Settling after legal escalation starts

Most losses in settlement come from avoidable mistakes.

Read real client stories of successful credit card settlement and debt relief.Negotiation Scripts You Can Use

These scripts are crafted for Indian recovery and collections teams.

Opening statement

“I am unable to continue full repayment due to financial difficulty. I want to settle the dues through a one-time lump sum. I can arrange ₹_____.”

Counter-offer

“₹_____ is the maximum amount I can arrange. If this closes the account fully, I will pay immediately after receiving the settlement letter.”

Request for settlement letter

“Please send the settlement letter with the final amount, waiver details, and confirmation that there will be no further recovery.”

Frequently Asked Questions About Credit Card Settlement in India

Does settlement close the debt fully?

Yes, once the settlement amount is paid and documented.

Will the issuer chase me later?

No, not if you have proper settlement documents.

Can I get future loans?

Yes, after rebuilding your credit.

Does settlement stop recovery calls?

Yes, once the account is closed.

Is settlement legal in India?

Yes, it is an accepted resolution process.

Credit Card Settlement Readiness Checklist

Before you settle, confirm:

- You know your exact outstanding

- You understand overdue days

- You can arrange a lump sum

- You have spoken with the issuer

- You received a written settlement letter

- You paid through traceable mode

- You collected no-dues certificate

- You checked your credit report

- You created a credit rebuilding plan

This ensures a clean, safe, and final settlement.

Conclusion

Credit card settlement in India is not a loophole or an escape route—it is a structured, intelligent decision when repayment is no longer possible. It helps you regain control, reduce stress, close unmanageable debt, and restart your financial life with clarity.

Yes, it impacts your credit report temporarily.

But it saves your future, your dignity, your peace of mind, and your financial stability.

A setback is not the end.

Settlement is your turning point.

A stronger, more disciplined comeback begins the moment you choose clarity over chaos.

Your fresh financial chapter starts here.