CIBIL Suit Filed means that a lender has reported to the credit bureau (CIBIL) that legal action has been initiated against a borrower due to loan default or non-payment. It may or may not indicate an actual court case, but it negatively affects your credit score and loan eligibility.

If you’ve checked your credit report recently and noticed the term “CIBIL Suit Filed”, you’re not alone — and you’re not doomed either.

The phrase CIBIL Suit Filed often triggers confusion, panic, and a whole lot of misinformation. So let’s break it down clearly, calmly, and legally — with insights I personally share with clients every day.

Table of Contents

ToggleWhat Does “CIBIL Suit Filed” Actually Mean?

It simply means that your lender has reported to CIBIL (Credit Information Bureau India Ltd.) that they have initiated legal proceedings against you due to non-payment of a loan or credit card.

It does NOT always mean there’s an actual court case filed against you.

In many cases, it’s just a tactical move by lenders to pressurize you into settling or paying quickly.

Is This a Real Lawsuit?

Not necessarily. “Suit Filed” could mean:

- A Section 138 case for cheque bounce.

- A pre-arbitration notice was sent.

- A civil recovery suit has been filed (rarely).

- Or in many cases — no real case, just a reporting entry.

Pro Tip: Ask for a copy of any legal notice or court filing before assuming it’s real. Often, it’s just a bluff entry on your credit file.

Is It a Criminal Case?

No. In 99% of cases, “Suit Filed” refers to a civil matter — not a criminal case. It’s often about recovery or arbitration, and not about arrest or FIR.

However, if there’s a cheque bounce involved under Section 138 of the NI Act, that could involve criminal proceedings — but even that needs proper legal procedure.

So, breathe easy. You won’t be arrested just because you saw this term on your report.

How Does It Affect You?

Badly. Here’s what a “Suit Filed” status can do:

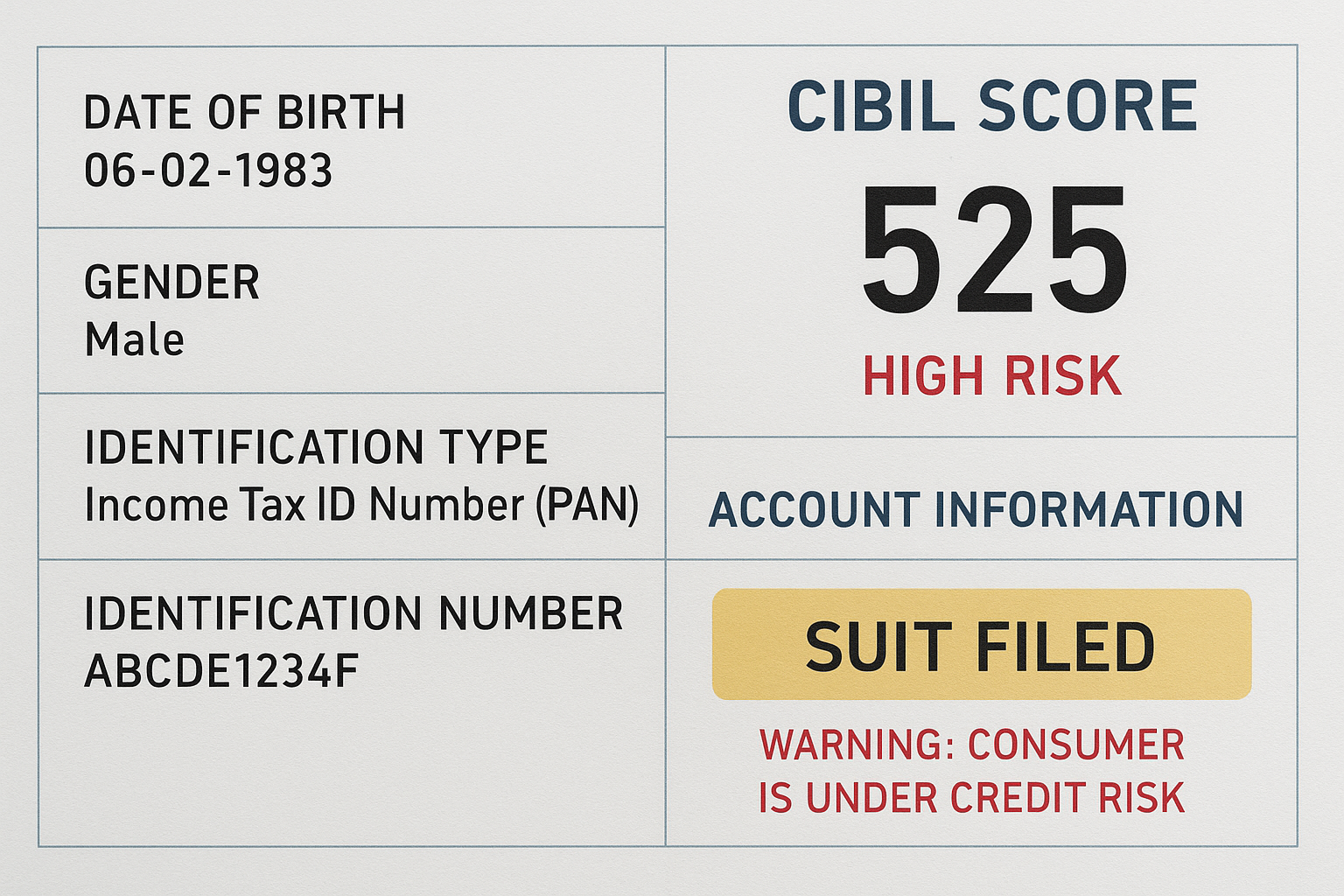

- Tank your CIBIL score (sometimes below 600)

- Make future loans nearly impossible

- Mark you as a high-risk borrower

- Create suspicion during background checks

Even if the case is not real, the impact is.

Warning: Just because you repay doesn’t mean the tag is removed. Many borrowers pay and still suffer because the lender doesn’t update the report.

Also Read: How to Check Active Loans on Your PAN Card

Related Guide: Recovery Agent Harassment Rights in India – Know Your Protections

How Long Does It Stay on CIBIL?

A “Suit Filed” entry can stay for 7 years or more unless the lender updates the status. Even if you repay later, it doesn’t automatically get removed.

You must either:

- Settle with the lender and get a “settled” or “closed” status.

- Raise a dispute with CIBIL if the case was wrongly filed.

Until then, it just sits there hurting your credit health silently.

A lingering CIBIL Suit Filed remark can silently damage your profile even after the debt is settled

Why Did They File It Against You?

Some reasons include:

- Long default periods (usually over 90 days)

- Missed EMIs or credit card payments

- No response to repeated notices or calls

- Disputes or chargebacks left unresolved

Sometimes it’s done unfairly — that’s where your rights come in.

You May Also Like:

Real Case Example

Ravi from Mumbai missed 4 EMI payments due to job loss. He started getting daily recovery calls. One day, while checking his CIBIL on OneScore, he saw: “Suit Filed – Bajaj Finance.”

He panicked, thinking police might show up. In reality, it was a pre-arbitration entry, not an FIR. He booked a legal consult, replied smartly to the lender’s notice, and began negotiations.

Ravi’s report clearly showed the CIBIL Suit Filed status under account remarks, even though he had never received a legal summons.

His CIBIL was still affected — but at least there was no actual case, and he avoided further harassment.

Bonus Tip: Always save screenshots of your CIBIL report and communication with the lender. It helps in future disputes.

What Can You Do If You See This?

- Don’t panic — verify it.

- Check your full credit report on CIBIL.com or via apps like OneScore or Paytm.

- Contact the lender.

- Ask for details: Which loan, what case, when was it filed?

- Get legal clarity.

- Most borrowers assume it’s a criminal matter. It’s not — it’s civil or arbitration most of the time.

- Use documentation tools.

- If you’re being harassed, start documenting everything.

- Use our free SDS Harassment Tracker: https://sharmadebtsolutions.in/harassment-tracker

- Dispute it, if it’s wrong.

- You can raise a dispute with CIBIL to get incorrect entries removed.

- Consider professional help.

- If you’re confused or scared, book a consultation. One mistake in your reply can trigger real legal action.

CIBIL Suit Filed? Here’s What To Do:

- Confirm your credit report from CIBIL.com or OneScore.

- Contact the lender and ask for written proof of legal action.

- Check if it’s arbitration, civil suit, or just a bluff entry.

- Save all communication — use our SDS Harassment Tracker.

- Don’t panic-pay — negotiate only with written terms.

- Raise a dispute on CIBIL if the entry is false or unfair.

- Still confused? Book a paid consultation on WhatsApp.

Should You Pay or Negotiate?

Don’t pay blindly just because you saw “Suit Filed.” Many lenders use this term to scare you into paying unfair amounts.

Instead:

- Ask for a settlement letter with clear terms.

- Negotiate the total amount, especially if you’ve paid some EMIs already.

- Never agree verbally — get everything in writing.

Sometimes paying immediately without legal clarity leads to regret — especially when your CIBIL isn’t even updated after payment.

More Help: How to Negotiate a Personal Loan Settlement

Talk to us directly on WhatsApp and get expert guidance.

Book Paid Consultation on WhatsApp

Don’t reply blindly — one mistake can worsen your case. Book a paid consultation directly with us on WhatsApp.

Book Consultation Now

People Often Asks Us

Confused after seeing “Suit Filed” on your credit report? You’re not alone. Here are questions people ask us all the time — answered clearly.

What does suit filed mean in CIBIL?

It means the lender has informed CIBIL that legal action has been initiated for non-payment. It doesn’t always mean a court case.

Can suit filed be removed from CIBIL?

Yes. It can be removed if you settle the debt and the lender updates the report, or if you raise a dispute and win.

How long does suit filed stay in CIBIL?

Typically 7 years or more unless removed by the lender or resolved through dispute.

Is suit filed a criminal case?

No. It’s mostly civil or arbitration-related. Criminal charges are rare and require separate legal process.

Should I pay after suit filed?

Don’t pay blindly. First, get legal clarity, negotiate terms, and ensure you get written confirmation from the lender.

Related reading

Final Thoughts

Seeing “Suit Filed” on your CIBIL report feels terrifying — but it’s just a signal. It’s not a sentence.

Lenders use it to pressure borrowers, but you still have rights, time, and options. Understand it, document your case, and respond wisely.

You’re not alone — and you’re definitely not helpless.

If this helped, share it with someone silently dealing with loan pressure.

Don’t let a CIBIL Suit Filed mark ruin your future loans or peace of mind. There are ways to fix it — the smart way.

Need help understanding or responding to a notice?

WhatsApp us (Paid Consultation): 9106484927

Stay aware. Stay protected. Stay in control.

Authored by Mr. Sharma

Founder of Sharma Debt Solutions and India’s go-to expert for legal loan and credit card settlement. With hundreds of borrowers helped across the country, Mr. Sharma combines hands-on support with practical tools like the SDS Harassment Log and many more.

Message on WhatsApp